While dealing with troubled or nonpaying customer can be difficult and costly, it should be remembered that no relationship is unsalvageable.

Determining the worth of a customer should be judged by a number of factors, including any personal relationships.

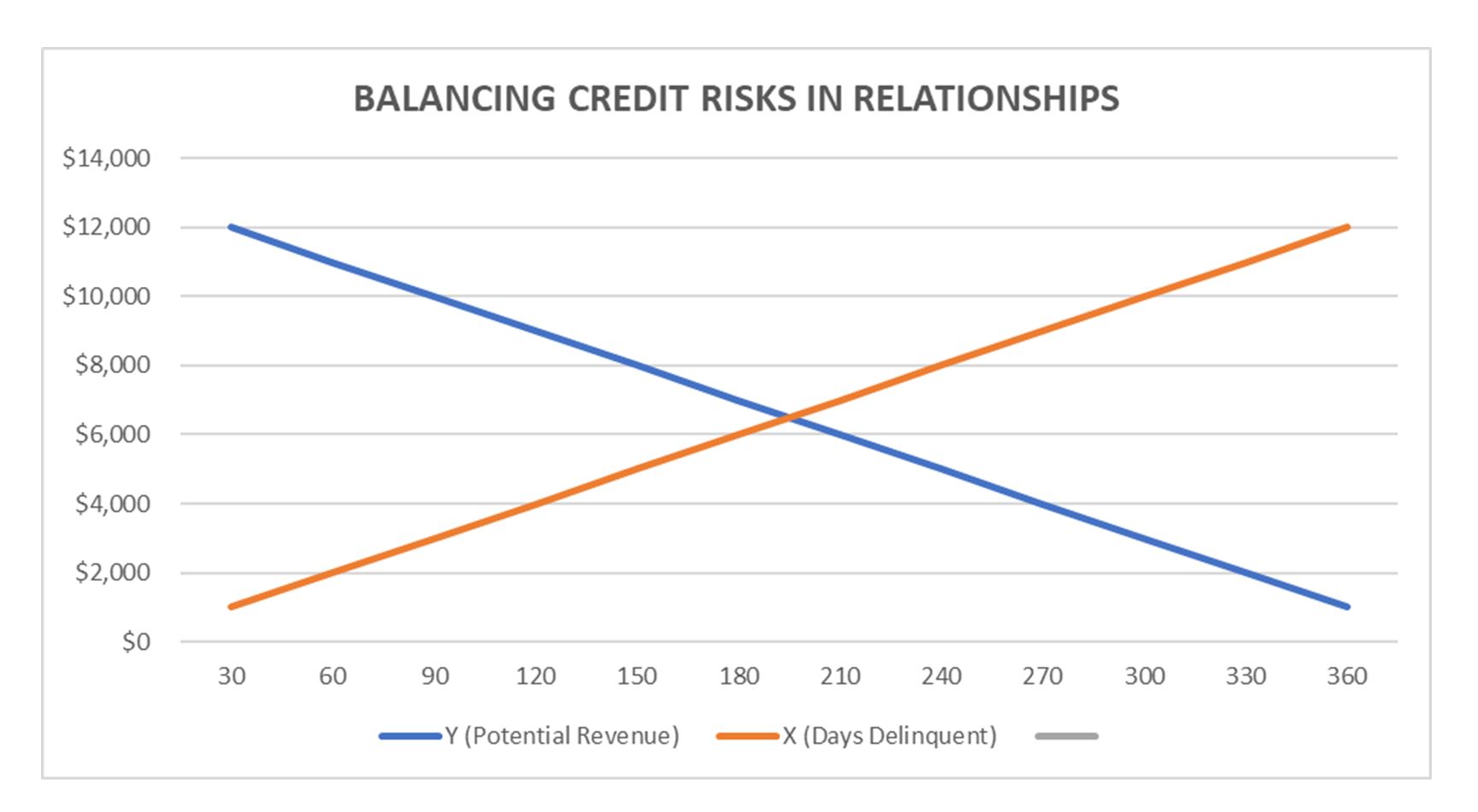

Ultimately, if a poor-performing customer has the potential to damage your business, it’s crucial to know when the risk has gone from marginal to toxic, regardless of the personal relationships involved.

Remember, too, that while credit risk is a paramount factor in deciding whether or not to end a customer relationship, there is more to it than cash flow.

Problematic trading partners can cost time as well as money and accommodating difficult customers that aren’t paying is a recipe for disaster.

Many business owners tend to think success is measured by the total number of customers, but a customer that demands more than it is willing to give is a net loss, not a net gain.

Hootsuite CEO Ryan Holmes solved this problem by charging customers based on the demand they put on company services, a clever tactic for edging out problem clients without making it seem he was doing so.

Finally, remember that the best time to deal with potentially risky customers is before entering into a relationship. Calculate the tolerance of risk, reevaluate frequently, and make expectations clear.

And when it comes to the risks associated with longtime customers that appear to be struggling, open, honest, and frequent communication will be best for the relationship, on both sides.

This is an excerpt from a Credit and Finance feature in the November/December issue of Produce Blueprints Magazine. Click here to read the full feature.