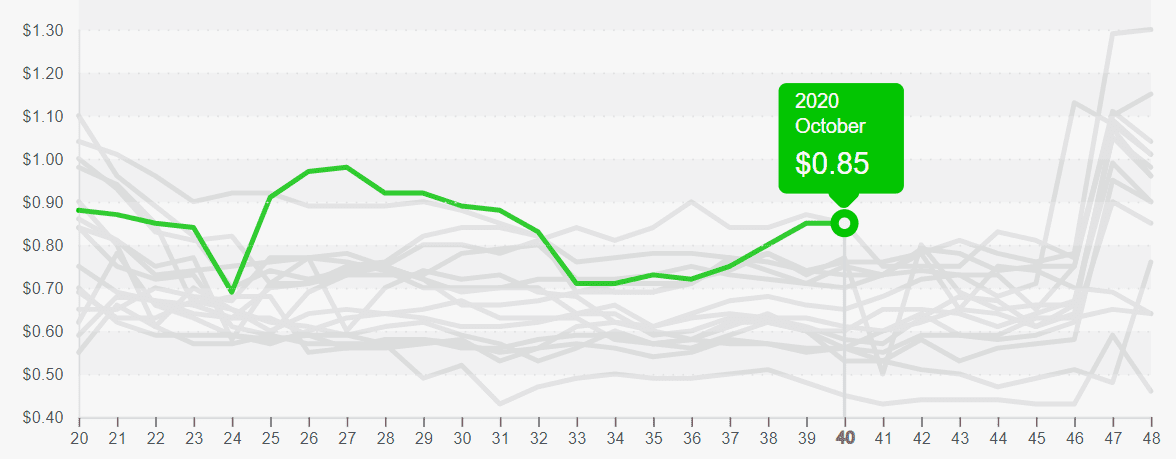

Week 40 prices have only reached the high of $0.85/pound once before in the last 15 years.

Historically, prices decline through October until the Thanksgiving demand pulls them back up again at the beginning of November.

Is higher demand the reason behind this year’s record high summer prices? Unfortunately not, as the overall movement is down. This year, decreases in supply have simply been more dramatic than the decreases in demand, balancing to higher prices.

ProduceIQ Index: $0.85 /pound, flat over prior week

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

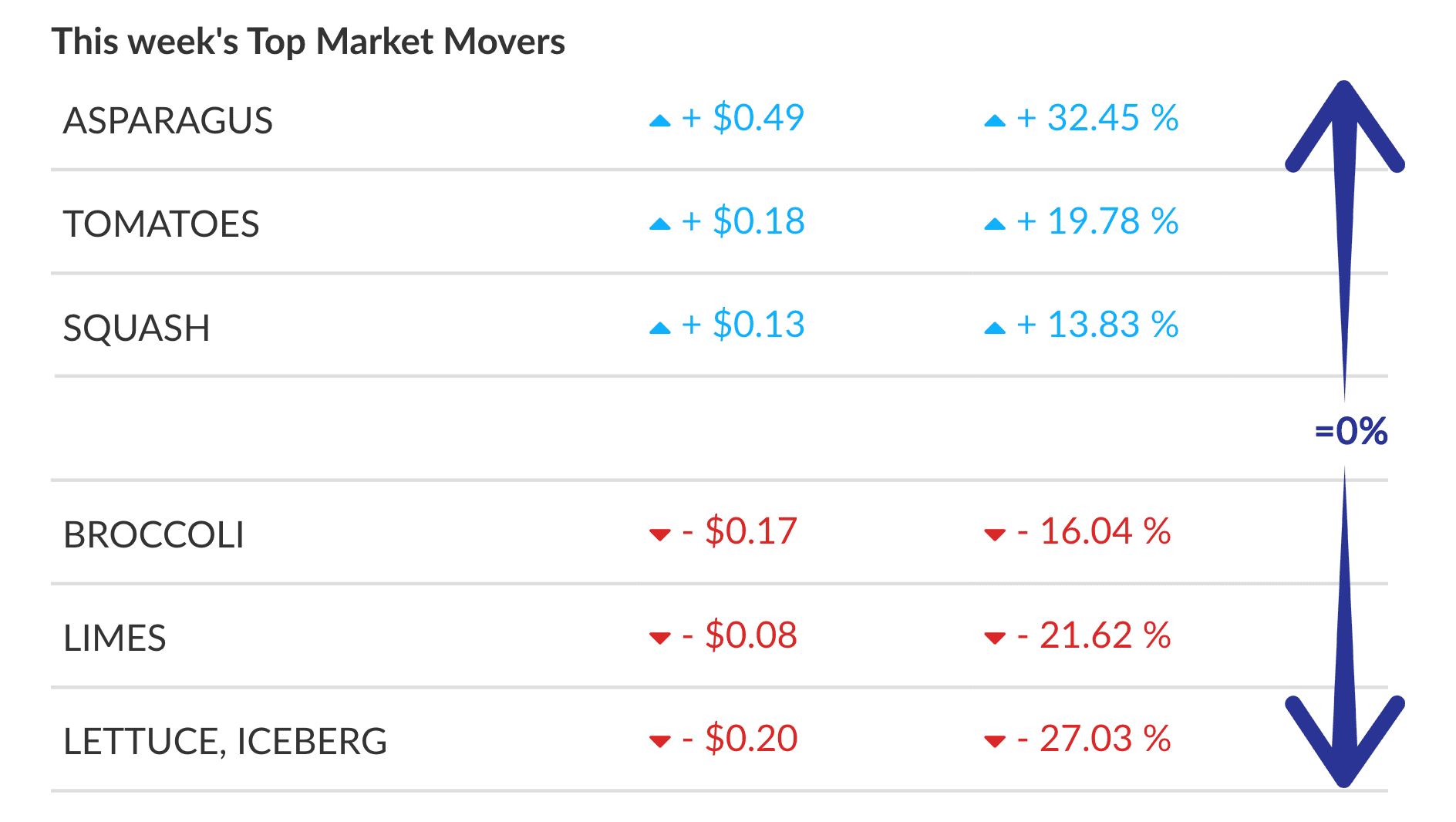

New fields of Iceberg provided immediate relief to the elevated prices, falling 27 percent to $0.54 /pound. Direction is still uncertain, and markets are anticipated to remain volatile in the coming weeks.

Limes are receiving mixed reports. Some shippers claim supply shortages, and others assert that limes are plentiful and a bargain. Overall, quality is good, and given the low-price level of $0.29/pound, buyers are ignoring the sales rhetoric.

Produce IQ views limes as a buy worth promoting. After all, what shopper can’t use a few extra limes to “find their beach” in 2020?

Celery is a clear buy at $0.16/pound. Supply is both quality and quantity.

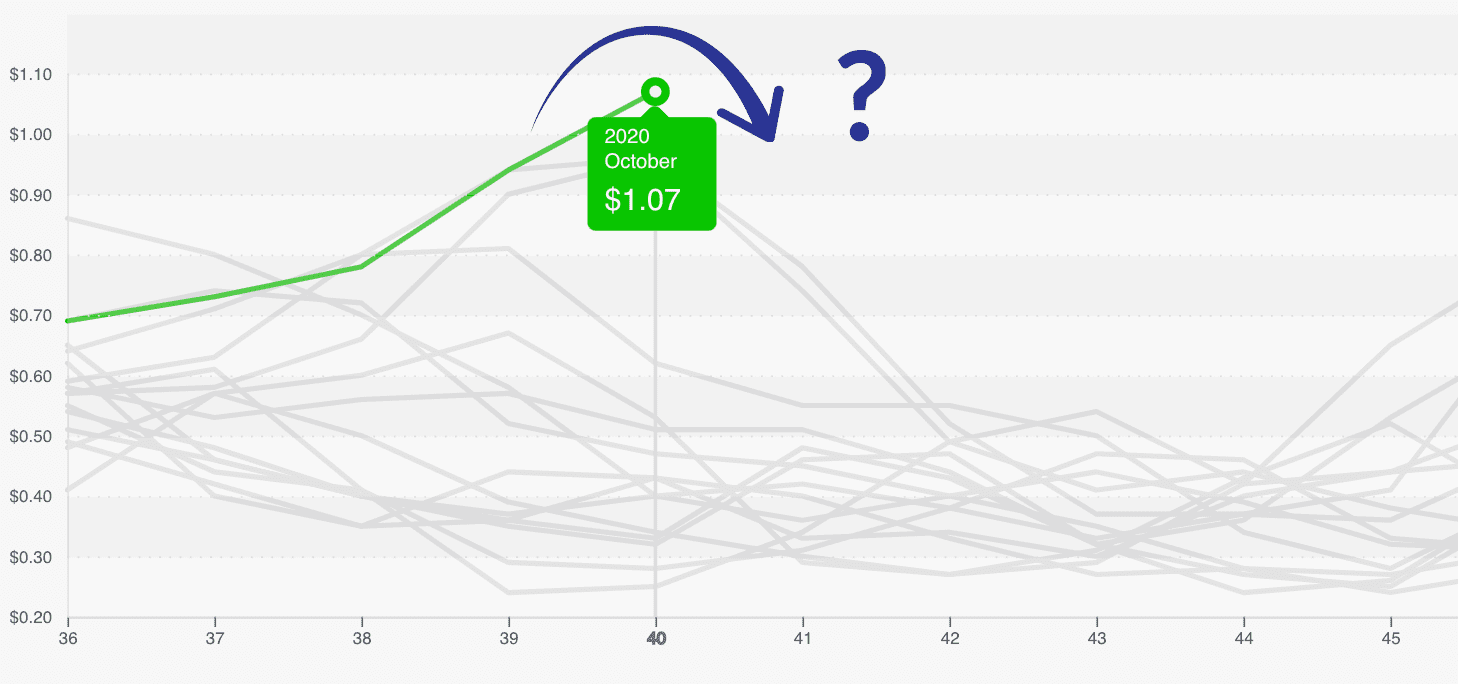

Squash is currently at the top of the roller coaster, staring down their inevitable descent. Supply is low in the East, but Mexican production is about to start. Hermosillo region grows a significant volume of quality squash. Anticipate that prices fall as October progresses.

Tomatoes jumped 20 percent on dwindling supplies in the East. Cooler weather following hurricane-induced rains, is causing lower yields. Mexican crops are starting early, though insufficient to offset volume reductions. With less acreage in Florida, anticipate continued price sensitivity through October.

Asparagus supplies are down from both Peru and Mexico, which are not yet at peak harvest. Anticipate higher prices during a 2-week lull in production.

Squash prices are at a 15-year high, though production in Northern Mexico is starting.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.