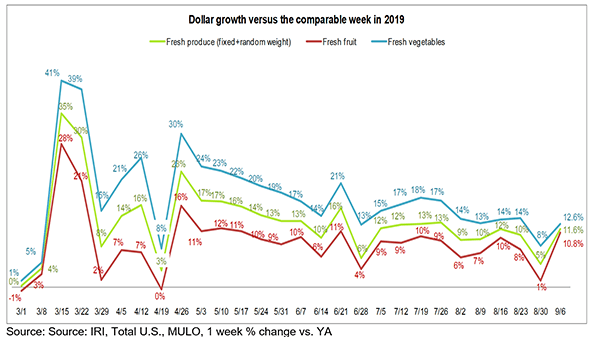

Labor Day boosted virtually all departments back into double-digit gains over year ago, particularly with the holiday weekend falling a week later than it did in 2019. Fresh produce had a stellar week, with gains far exceeding those seen the week prior.

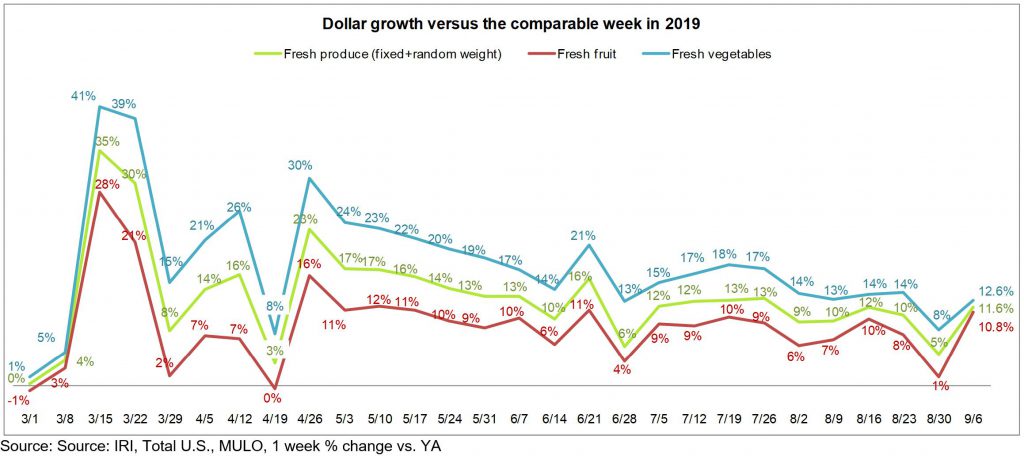

For the week of September 6th, fresh fruit and vegetable sales increased 11.6% over 2019 — actually surpassing growth in shelf-stable fruits and vegetables. Frozen fruits and vegetables had the highest growth percentage, however, of a much smaller base. Year-to-date through September 6, fresh produce department sales are up 11.2% over the same time period in 2019. Frozen fruit and vegetables increased the most, up 26.7% year-to-date.

“It is great to see produce close out the summer with a strong Labor Day performance,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “Both fruit and vegetables were up double digits versus year ago and that is solid momentum going into the fall season. We need to continue to support shoppers in their healthy eating efforts, make sure we convert on every trip, online and offline, and help shoppers with meal ideas and easy solutions as they continue to prepare more meals at home.”

Fresh produce generated $1.32 billion in sales the week ending September 6th — an additional $137 million in fresh produce sales over the prior year. While a strong result, this is actually below the pandemic average for additional dollars, at $181 million per week though higher than the June, July and August averages. Vegetables grew 12.6% versus year ago and fruit had a very strong week, up 10.8% during the week of September 6.

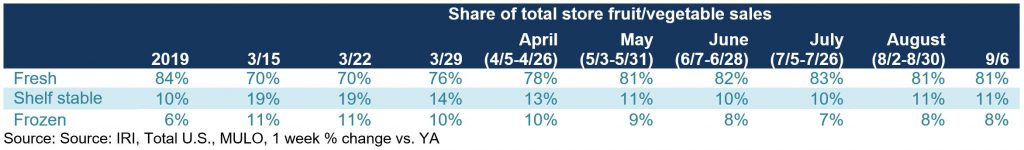

Fresh Share

Fresh produce commanded an 81.3% share of total fruit and vegetable sales across all three temperature zones during the week ending September 6 — unchanged versus the week prior but still down from 2019’s 84% average.

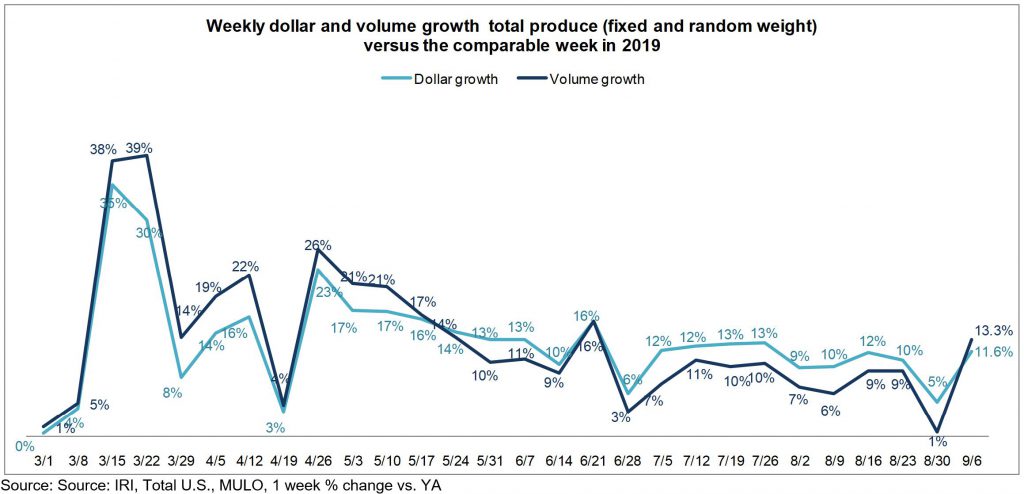

Fresh Produce Dollars versus Volume

One of the bigger surprises this week came in the form of volume sales that exceeded dollar sales due to a very strong performance on the fruit side. The week of September 6th experienced a 13.3% volume increase, up from just 1% the week prior.

“We have not seen volume track ahead of dollar gains since the middle of May,” said Jonna Parker, Team Lead Fresh with IRI. “It looks like grocery retailers went in with very sharp prices for Labor Day to close out the summer season with a bang. Volume sales were at their highest level since the week of June 21, which was Father’s Day.”

The strong produce volume performance was driven by fruit, that saw a 14.4% increase in volume versus the same week year ago — up from -1.2% the week prior. Vegetables had strong, double-digit volume gains as well, but they tracked slightly below dollar gains.

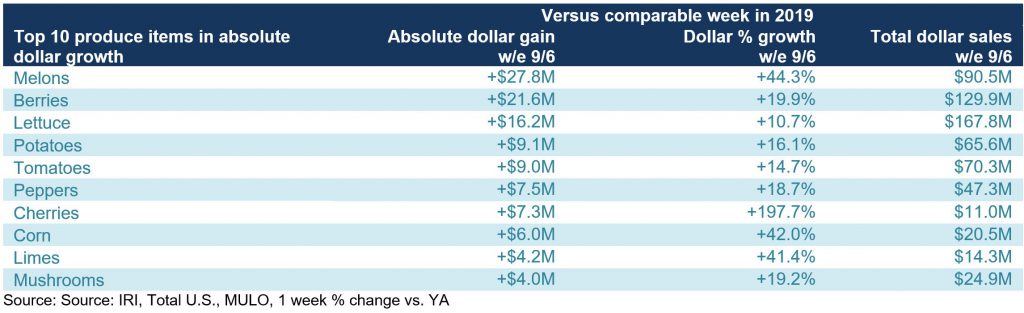

Absolute Dollar Gains

“What a way to close out summer with melons and berries leading the top 10 in absolute growth,” said Watson. “Melons delivered an additional $27.8 million in new dollars, followed by $21.6 million for berries and $16.2 million for lettuce. Cherries and limes close out a very strong top 10 for fruit this week.”

Retailers invested in price this week, with many fewer items showing double digit inflation. Whereas corn, peaches, limes and roots had been experiencing high inflation for weeks, prices were much more moderate this week. Tangelos, watercress, cactus leaves, artichokes, cauliflower and dates still experienced double-digit inflation, but with the exception of cauliflower, those tend to be smaller sellers for most retailers. Instead, there were many more items with double digit deflation, including avocados, mangoes, papayas, Brussels sprouts, cherries and pineapples. Cherries grew dollars 197.7% versus the same week year ago, despite prices being down 11.5% versus year ago.

The Pandemic Top 10 in Absolute Dollar Gains

A look back at the pandemic weeks between March 15 and September 6 shows some astounding gains during the 26-week period for both vegetables and fruit.

“The produce pandemic powerhouses start with berries, potatoes and lettuce,” said Watson. “Berries and lettuce are massive categories that still averaged double digit growth over the 26-week period. Some real surprises are much smaller categories that punched well above their weight with very high weekly gains, including oranges and mushrooms. It is important to think about the why. In the case of oranges, an important lesson is stressing the nutritional benefit of fruits and vegetables. And mushrooms provide an excellent example of the impact of the foodservice dollar moving over to food retail.”

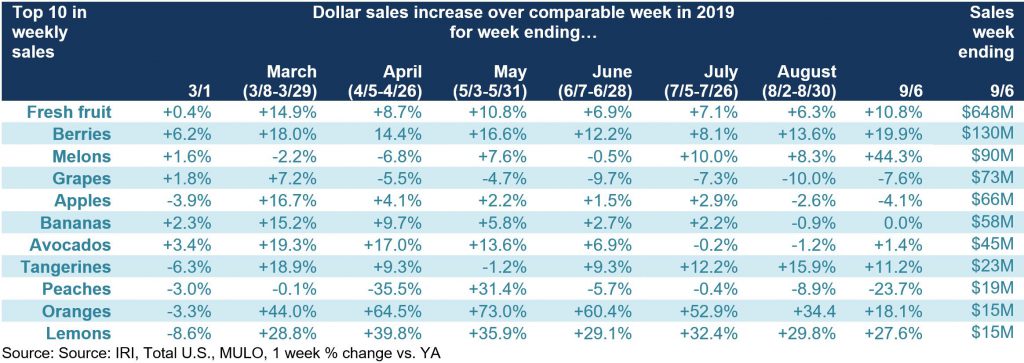

Fresh Fruit

“In fruit, berries remained dominant in sales but melons had a monster week, at $90 million,” said Parker. “Whereas melons struggled the prior week in going up against Labor Day 2019 sales, they are clearly still a holiday winner, with gains of 44.3% over year ago. Others that performed very well during the holiday week were berries, oranges and lemons, whereas avocados continued to be plagued by double-digit deflation.”

Fresh Vegetables

The top 10 in sales on the vegetable side included seven items that had double-digit increases versus year ago.

“Much like melons on the fruit side, corn had a fantastic Labor Day weekend performance,” said Watson. “With the investment in price, corn increased 42% in dollars, which was far ahead of the gains seen for other categories. Lettuce, however, easily remained the dominant player in sales, at $168 million in weekly revenue.”

More than three-quarters, 78.4%, of total lettuce sales was made up by fresh-cut (packaged) salad. Dollar gains for fresh cut salad have been very constant at around 10% above year ago levels. Volume sales increased 9.3% and units (transactions) grew 8.0% during the holiday week.

Throughout the pandemic period, fresh produce had an average of $13.6 million additional dollar sales per week, which resulted in $353.3 million additional dollars in fresh cut salad between March 15 and September 9 versus year ago, for total pandemic sales of $3.5 billion.

Category Engagement

July and August continued to see elevated levels of household penetration, trips and spend per buyer versus year ago levels. These were all weeks where everyday demand carried the year-over-year gains, which means the produce department won on every area of growth, with the one exception of the week ending August 23, where trips saw a small decline.

Fresh versus Frozen and Shelf-Stable Fruits and Vegetables

Holiday week or every day demand, frozen fruit continues to do extremely well. Frozen fruit has seen some extremely high growth rates, though off a much smaller base than fresh and shelf-stable fruit. During the week of September 6th All areas experienced growth, though gains for shelf-stable fruit and vegetables remained in single digits.

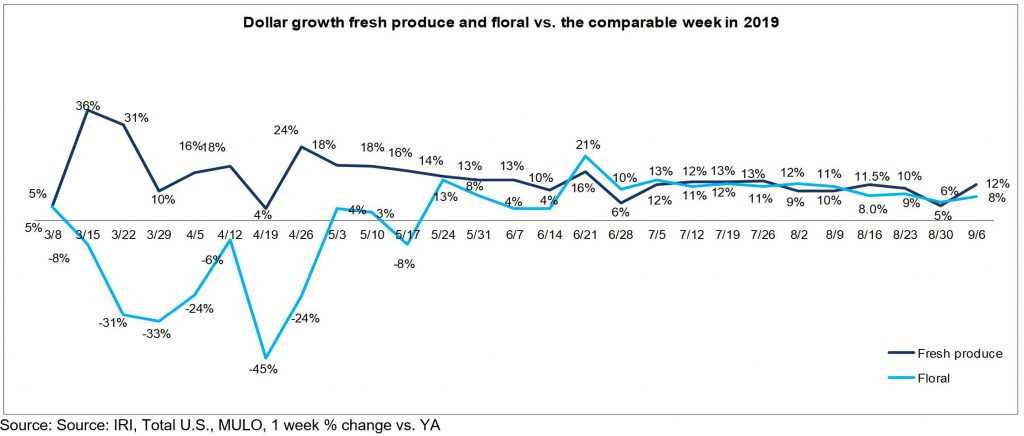

Floral

Floral sales remained well above 2019 levels during the holiday week. Floral struggled early on in the pandemic as retailers focused on keeping the produce department stocked, but has been trending well above year ago levels ever since May.

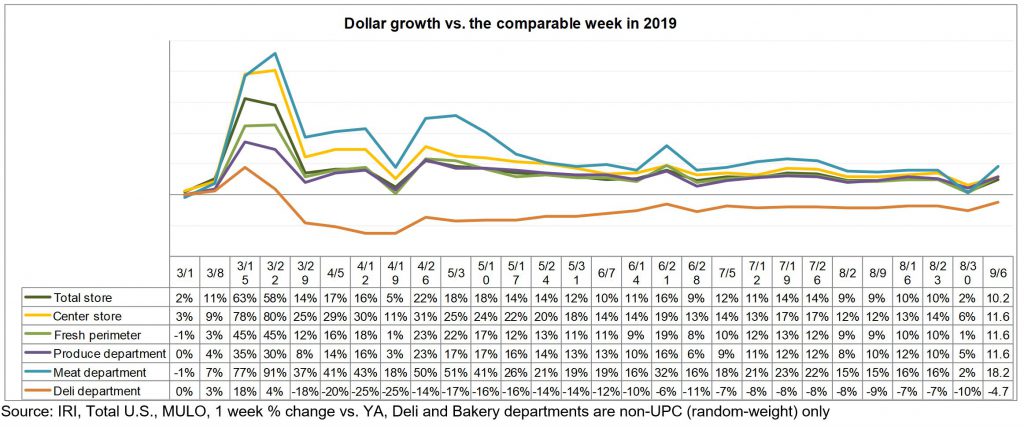

Perimeter Performance

The strong Labor Day performance provided a boost for virtually all departments. After being surpassed by produce for the first time since the start of the pandemic, the meat department bounced back with a big gain during the holiday week, at +18.2%. Total deli, which encompasses non-UPC, random-weight deli cheese, meat and prepared foods, remained pressured, due to deli-prepared sales’ continued struggles.

What’s Next?

This is the last in the series of weekly reports IRI, PMA and 210 Analytics have produced since the week of March 15, but will continue to provide updates on a monthly basis.

Excluding weeks that were affected by the 2019 or 2020 holiday demand, everyday demand is normalizing at around 10% above year ago levels. The number of new COVID-19 cases appears to be leveling off and consumer concern along with it. Restaurant transactions continue to come back a little at a time, but remain below year-ago levels. Aided by the effect of virtual schooling, produce sales are likely to hold well above 2019 levels for many weeks to come.

We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns. Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times.