The avocado market has seen steady prices and good volume in the second quarter compared to a roller coaster first quarter.

Prices are about half that of the second quarter last year. The volume increases are led by Mexico and California, which should start seeing its supplies wind down this month.

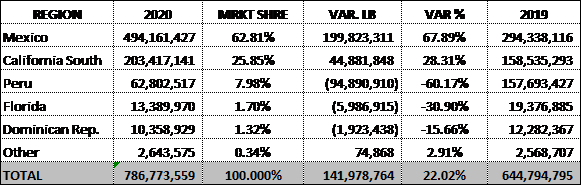

YTD VOLUME FOR CONVENTIONAL AVOCADO MARKET

In the first quarter of 2020, the market presented surprising production lows, said Raul Lopez, agronomist and vice president of Agtools Inc. BB #:355102

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

The lowest point was at the beginning of the lockdowns. However, after mid-April the market reacted positively and for the period of January through July, there was an increase of 19 percent versus the volume in 2019, he said.

The 2020 volume is also 3 percent greater versus 2018. Over the last 90 days, the market registered significant growth and has also become steadier.

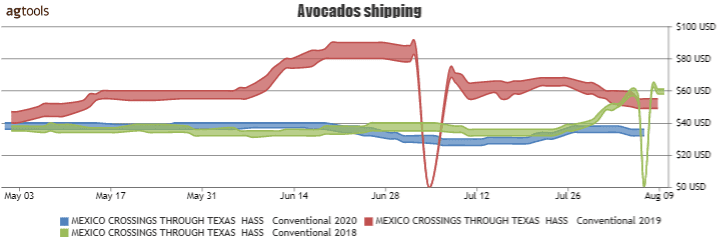

F.O.B. PRICE AT McALLEN TX. FOR MEXICAN AVOCADOS SIZE 48’S

The price for size 48’s in the last 90 days has been steady, fluctuating between $30-40 with no surprises. This is very similar to 2018, and a lot cheaper than in 2019 when it peaked close to $90.

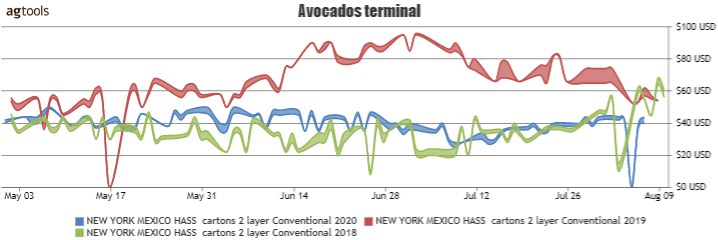

NEW YORK TERMINAL MARKET PRICE FOR CONVENTIONAL AVOCADOS FROM MEXICO SIZE 48s

The price in the New York market presented its lowest in the last 90 days in the second week of July, then has increased slowly from low $30s to the $40s last week, Lopez said. If the volume available continues and there are no big changes in the F.O.B. market price this trend is likely to continue.

RETAIL PRICE FOR AVOCADOS IN THE NORTHEAST REGION

Retail price of avocados in the las 90 days have fluctuated from $0.75 to $3 each, which peaked in the first week of June. The range is very similar to that of 2019, however this year there is a lot more volume available, Lopez said. Lately, the range has reached from a low price of between $ 1.50 and $ 0.75 each.

YTD VOLUME REPORT AND MARKET SHARE FOR THE LAST 3 MONTHS (MAY 1ST THROUGH AUGUST 8TH)

In the last 90 days, the market has grown 22 percent vs 2019. Mexico and South California have collected most of the growth during this period, Lopez said. Peru and Florida have had a big loss vs. 2019.