The national carrot market shows higher volume and pricing than the previous two years.

While those two things don’t usually go hand-in-hand, two factors may be leading unusual strength to the market. The pandemic has seen stronger consumer demand for many vegetables, and carrots are among them, posting 5-10 percent higher year-over-year retail sales in June.

Carrots are also a common item in a food box, and the USDA’s program started in mid-May and continues today, which could be propping up the market.

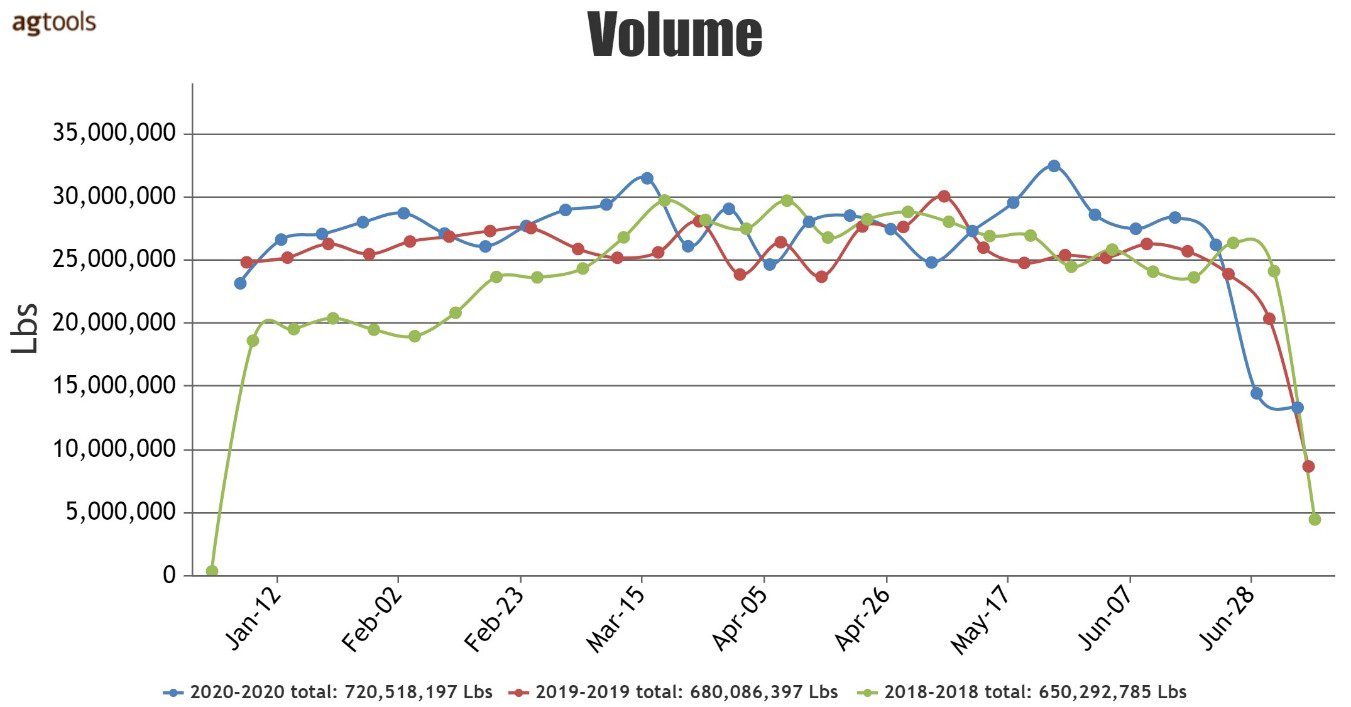

YOY TOTAL VOLUME INCREASES IN 2020 FOR CONVENTIONAL CARROTS

Total industry volume for conventional Carrots is showing an increase in 2020 for the first six months of the year. While the total volume is very similar to 2019 and 2018, there are two noticeable peaks, said Yolanda Ramirez, Director of Sales to Retailers for Agtools Inc.

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

Mid- May shows a peak over both previous seasons largely due to the panic buying experienced in the spring and may have also been the result of the Farmers to Families food box program.

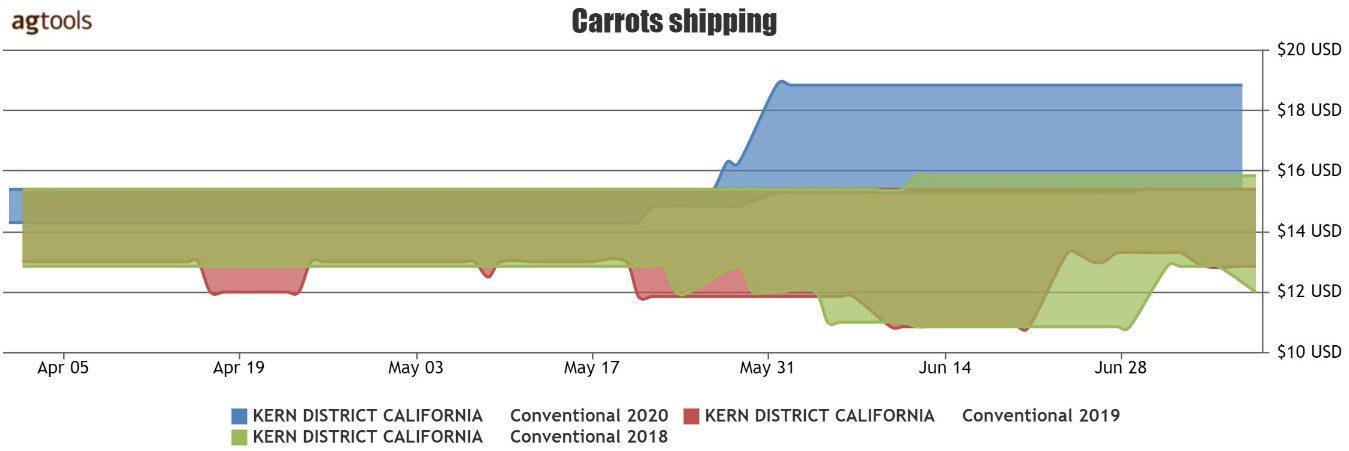

June/July F.O.B. PRICE FOR CONVENTIONAL CARROTS 48-1 LB. BAGS FROM KERN DISTRICT

As one of the most stable commodities, there is consistent pricing for extended periods of time. However, what is quite noticeable is the increase in F.O.B. shipping prices in May, when the Farmers to Families food box program began, Ramirez said.

A $3 increase in price which started toward the end of May, continues to hold strong.

CARROT NATIONAL RETAIL PRICES OVER 3 YEARS 1 LB. BABY PEELED

2020 National June retail prices are higher than both 2018 and 2019 for the 1-pound baby peeled carrot. Retail has been as high as $1.50 in June, which is considerably higher than the last 2 years during the same month. But prices have been falling since late June, Ramirez said.

January 1 thru July 8, 2020 VOLUME CHART FOR MAIN REGIONS CARROTS (CONVENTIONAL)

Central California is the largest producer of Conventional Carrots for this time frame with 62 percent of total volume. Mexico is the next largest producer with 26 percent of total volume.

Together these two regions make up 88 percent of total volume. Both of these regions are showing an increase in volume vs. 2019, along with Georgia and Canada, which essentially has replaced Israel in the market, Ramirez said.