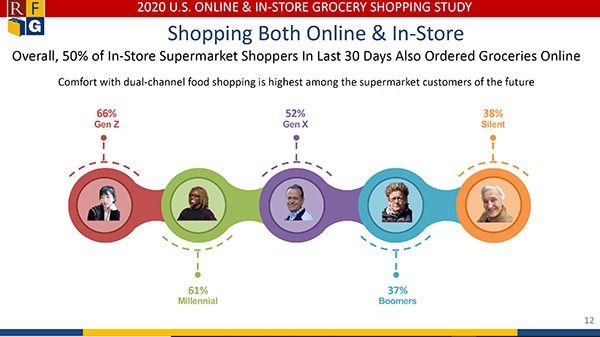

A new study from the Retail Feedback Group found 50 percent of in-store supermarket shoppers also ordered groceries online during the COVID-19 crisis.

Younger shoppers were far more likely than Gen X, Boomers and Silent generations to do so — but were also the least happy with their experience.

This makes sense to me as Gen Z, and to a degree Millennials, are digital natives in online shopping and have high expectations when it comes to the retailers they choose. The online shopping industry is full of customized features, digital try-ons, and savvy algorithms that pop up customized ads and deals. Grocery is just scratching the surface of these and hasn’t yet tapped suggestive merchandising the way other industries have.

Just take your social media feed for example. How many times have you casually mentioned or maybe googled something random only to find an ad for it in your social media feed?

It seems like only The Peach Truck has caught on to my love of fruits and vegetables so far.

I can’t tell you how many times I’ve come across ads for soccer cleats lately, as I was shopping for a new pair for my 11-year-old. They’re an ad on every site I browse nowadays.

I’m not sure how fresh produce marketers can tap these technologies on a meaningful scale, but it’s something that needs to be on our radar.

Gen Z also was a category that expects to be shopping for groceries less frequently online in the future. Another interesting stat, as many in the grocery industry have seen online shopping numbers to skyrocket and expect to keep some of that business once the crisis is over.

The way they’re going to have to do that, however, is to not only continue to meet high expectations in quality and service, but also continue to adapt and enhance the online shopping experience.

A few other nuggets:

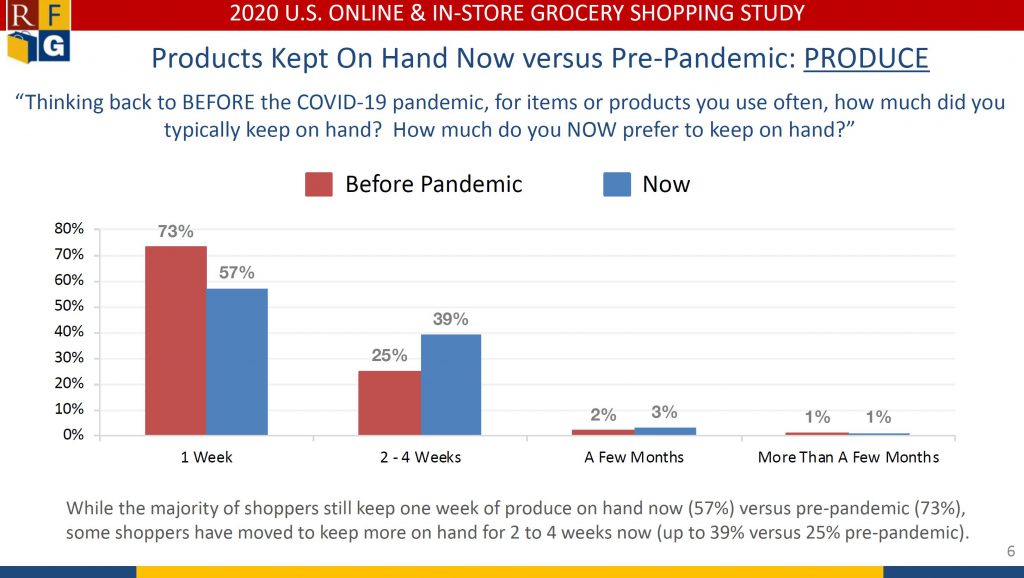

- People are planning to keep produce on-hand for longer. The majority still keep one week of produce on hand (57%) versus pre-pandemic (73%), but some shoppers are now keeping 2 to 4 weeks of produce on hand (from 39% to 25% pre-pandemic.

- This was the first time shopping online for about 1/3 of the survey’s respondents. Sixty-two percent of the shoppers used two or more providers in the past three months, suggesting they’re trying multiple services to see which can meet their needs, according to the study.

- Order pick-up gained popularity over delivery as well, jumping from 43 percent in 2018 to 51 percent in 2020. Delivery dropped from 57 percent in 2018 to 48 percent in 2020.

- Supermarkets also gained significant market share in online groceries, up 12 percentage points to a total of 35 percent market share while Amazon dropped 15 percentage points to about 14 percent of market share. Walmart, the market leader, also increased three percentage points to 40 percent of market share for online groceries in 2020.

You can get a full copy of the report from the Retail Feedback Group here.