Stability has mostly returned to the iceberg lettuce market as the crop shifted from the desert to central California.

Prices have been pretty steady this spring and are easing as summer approaches and volumes seasonally increase.

YOY TOTAL VOLUME DECREASES IN 2020 FOR CONVENTIONAL ICEBERG LETTUCE

Total industry volume for conventional Iceberg Lettuce is showing a slight decrease in 2020 for the first five months of the year. January and February performed on par with 2018 and 2019, at times slightly higher in volume, said Yolanda Ramirez, vice president of retail for Agtools Inc.

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

However, in March there is a substantial decrease during the abnormal buying trends due to the global crisis. After the mid-March decrease, the volume appears to stabilize to the normal trends of the last two years, but overall volume stayed below the level of previous years.

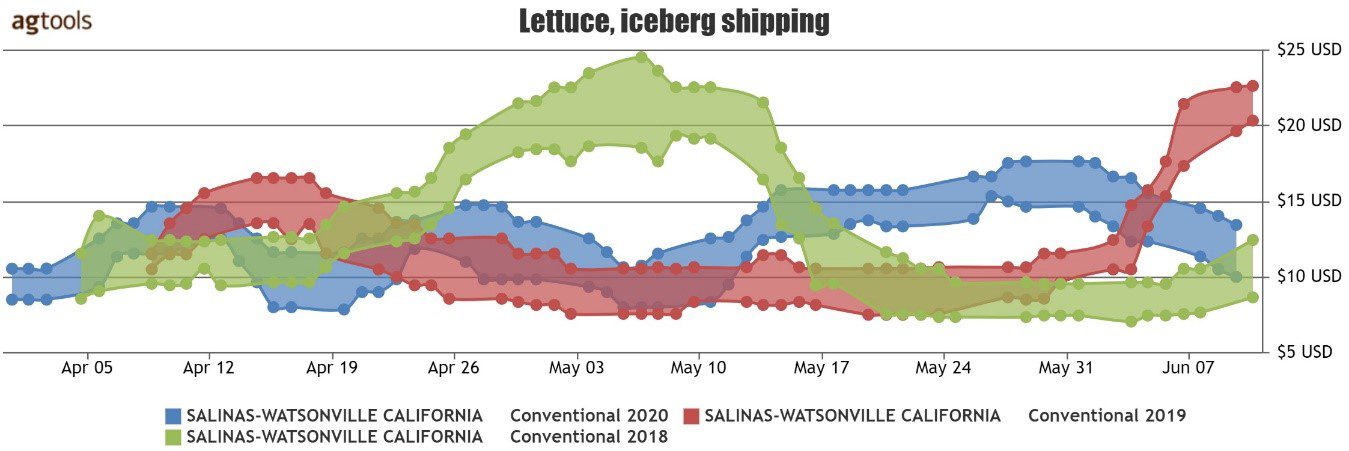

APRIL/MAY F.O.B. PRICE FOR CONVENTIONAL ICEBERG 24’s FROM SALINAS-WATSONVILLE

April 2020 F.O.B. Shipping Point pricing from Salinas-Watsonville was very similar to the past two years, Ramirez said. However by the middle of the month there were lower prices reported for Iceberg 24’s than both 2018 and 2019 and by the end of the month it trended up slightly beating 2019.

The beginning of May 2020 performed stronger than 2019 but saw prices drastically below 2018, where F.O.B. pricing was $20-25 for the first couple of weeks of the month. By the end of May 2020 Iceberg pricing recovered and beat both 2019 and 2018.

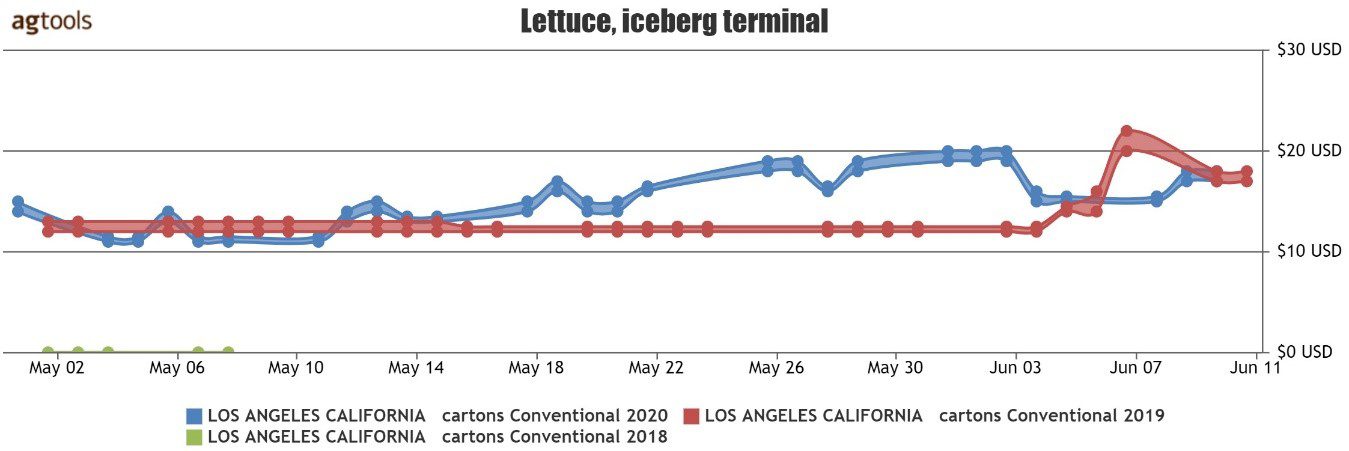

LOS ANGELES TERMINAL MARKET PRICE FOR CALIFORNIA ICEBERG

In 2020, Los Angeles terminal market prices have been slightly higher than 2019 for most of May, following a gradual but consistent increase, Ramirez said.

At the beginning of June prices began to fluctuate before leveling off at around $18, similar to 2019.

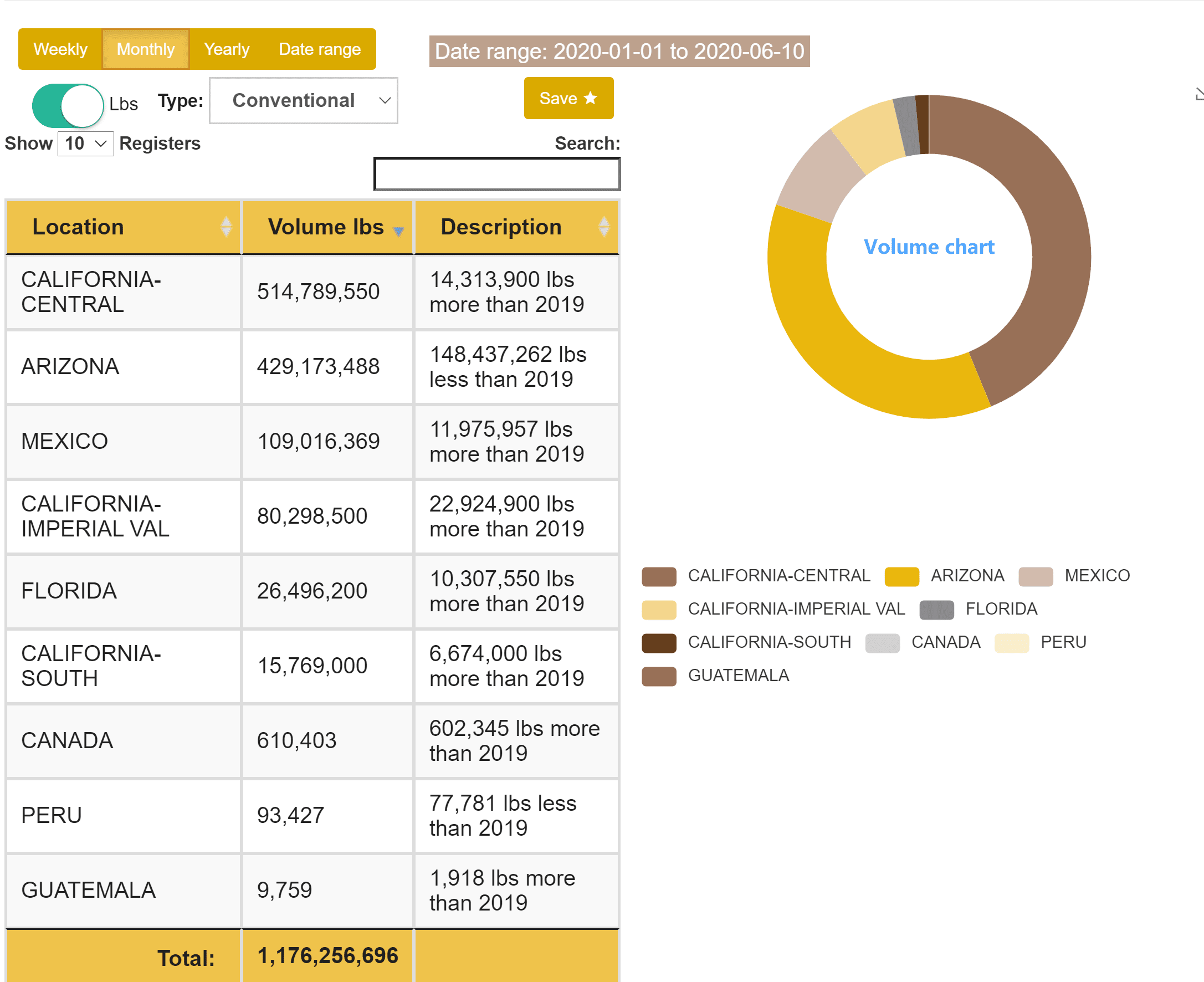

2020 VOLUME CHART FOR MAIN REGIONS (CONVENTIONAL)

California is the largest producer of Conventional Iceberg with three growing regions and 52 percent of total production January through May, Ramirez said.

Together with Arizona (36 percent of volume) and Mexico (9 percent of volume) these three regions account for 97 percent of total volume.

All three California regions, as well as Mexico, are reporting an increase in volume vs. 2019. While Arizona is reporting almost 150 million fewer pounds than 2019. Volume in Arizona was impacted by the pandemic in March with some growers having to plow fields under due to the sales pricing impact on this commodity.