Two months after panic purchases drove the biggest sales weeks in the history of modern grocery retailing, coronavirus-related shopping patterns for produce appear to be settling into a steady elevated trend line. In between Mother’s Day and Memorial Day, the week of May 17 was relatively free of holiday-related influences.

Driven by everyday demand that sits well above the old normal, grocery sales had another good week, and fresh produce along with it. 210 Analytics, IRI and PMA partnered to understand how retail sales for produce are developing throughout the pandemic and as restaurants around the country are starting to re-open dine-in facilities.

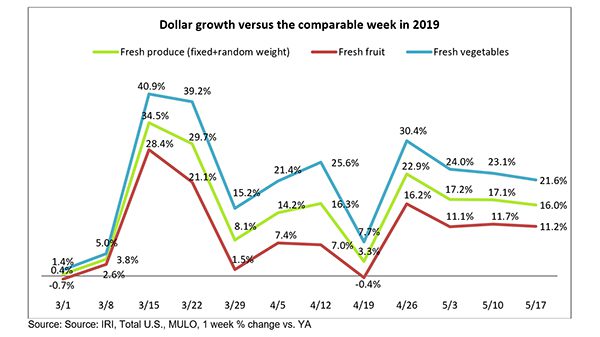

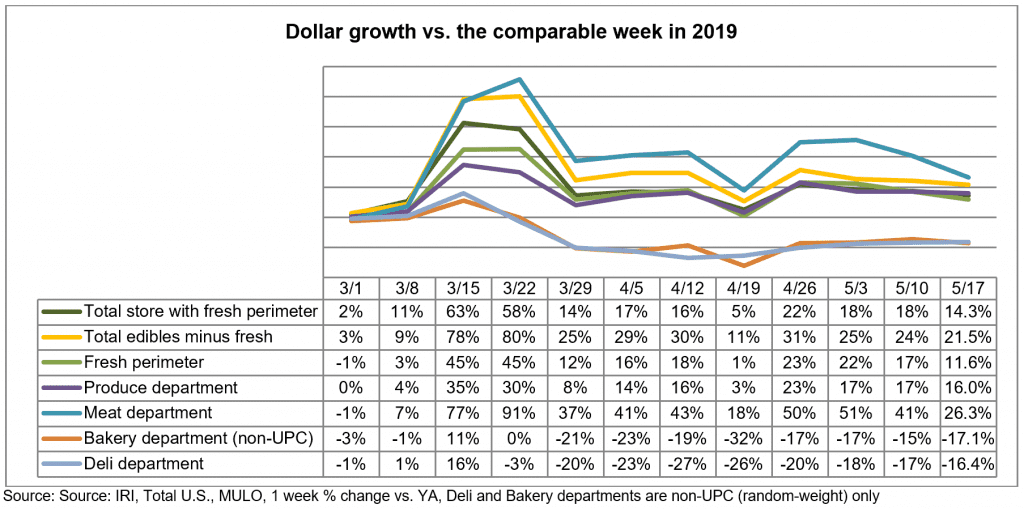

During the third week of May, everyday demand drove double-digit produce gains for fresh, frozen and shelf-stable fruits and vegetables. Fresh produce year-over-year growth for the week of May 17 versus the comparable week in 2019 increased 16.0% — very similar to the prior week’s 17.1%. Fresh vegetables continued to easily outperform fruit, but both achieved double-digit increases. Frozen once more had the highest gains, up 48.4%, despite continued high out-of-stocks in the frozen food aisle. However, frozen fruits and vegetables also reflect the smallest dollar and volume sales in addition to inflationary pressure.

- Fresh produce increased 16.0% over the comparable week in 2019.

- Frozen, +34.9%

- Shelf-stable, +26.5%

Source: IRI, Total US, MULO, % growth vs. year ago week ending May 17, 2020

“Due to rapidly changing shopping patterns and the effect of holidays ever since the onset of coronavirus, we have not yet had a week that is indicative of where elevated everyday demands sits relative to the old baseline,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “With the numbers holding in the high teens for the third week in a row, sales are starting to settle into a nice pattern. At the same time, with restaurants coming back online, we see more foodservice trucks loaded with fresh produce hitting the road and strengthening demand will improve overall market conditions.”

Fresh Produce

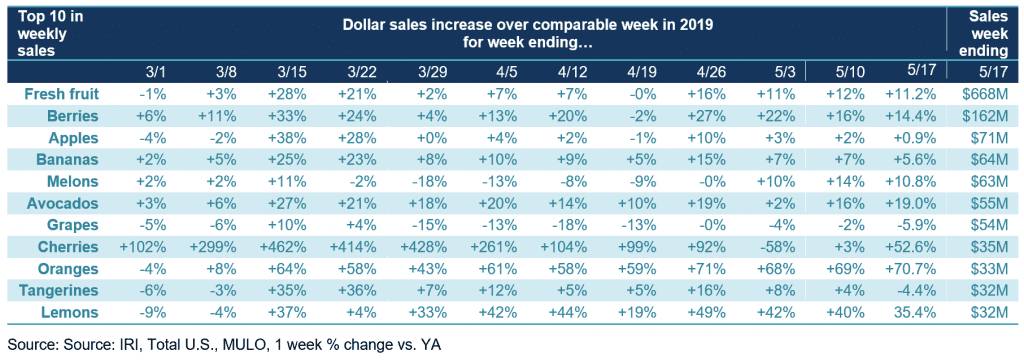

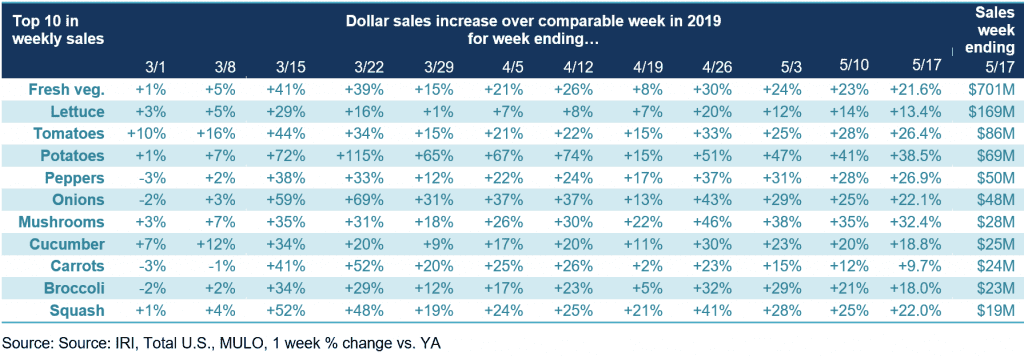

Compared with the same week in 2019, fresh produce generated an additional $192 million in sales during the week of May 17, or an additional 127 million pounds. Growth rates were in line with last week’s levels. Fresh vegetables, at +21.6%, continued to easily outperform fresh fruit and boasts double-digit increases for nine out of the last 10 weeks.

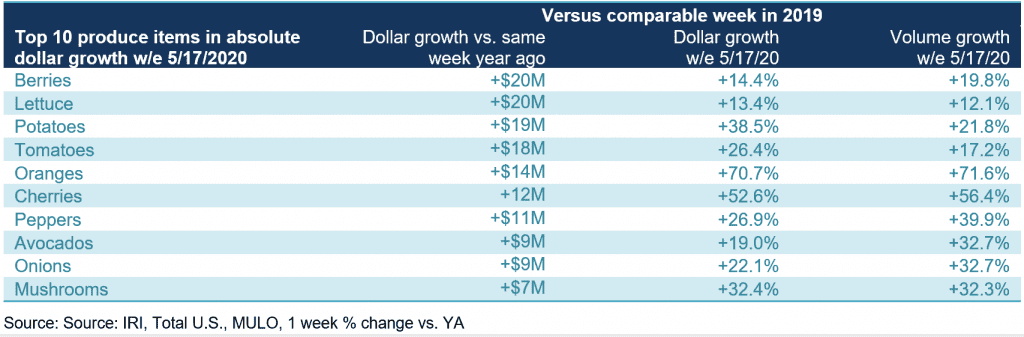

“We are off to a strong start for the summer fruit and vegetables season on the retail side,” said Jonna Parker, Team Lead, Fresh for IRI. “Cherries, for instance, came on very strong the week of May 17 with a more than 50% sales increase over last year. Berries continued to track well as did melons, both great indicators of summer season strength. And, on the vegetable side, seeing that corn continued to track nearly 30% ahead of the same week last year shows that consumers are engaged in the typical summer activities, albeit within new social distancing realities. These are some of the first signs that summer trends of years past will persist even during these unprecedented times.”

Fresh versus frozen and shelf-stable

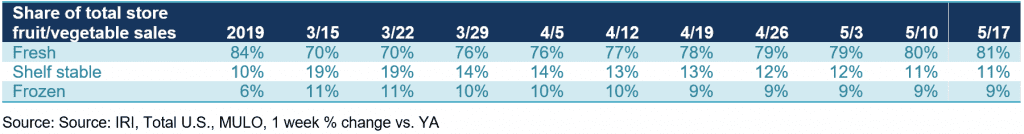

Percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total store fruits and vegetables. “In our survey, consumers said they were buying more fresh produce and the sales numbers are bearing this out,” said Watson. “During the two panic buying weeks, the share of fresh to total fruit and vegetable sales across the store stood as low as 70%, but in the latest week fresh is back to 81%.” During the week of May 17, deflationary pressure on fresh produce subsided somewhat.

Concern over the safety of fresh produce lingers for some shoppers. Some commented on the Retail Feedback Group’s Constant Customer Feedback (CCF) program this week.

One shopper wrote, “A mother and two children entered the store and refused to wear masks. They were touching many produce items and then returning them to the shelf.”

Watson commented, “Having visible safety measures such as staff wearing masks, hand sanitizer stations and encouraging shoppers to heed social distancing measures in-store is important to provide ease of mind that the fresh produce supply chain is taking every possible measure to ensure safe and ample supply of fresh produce.”

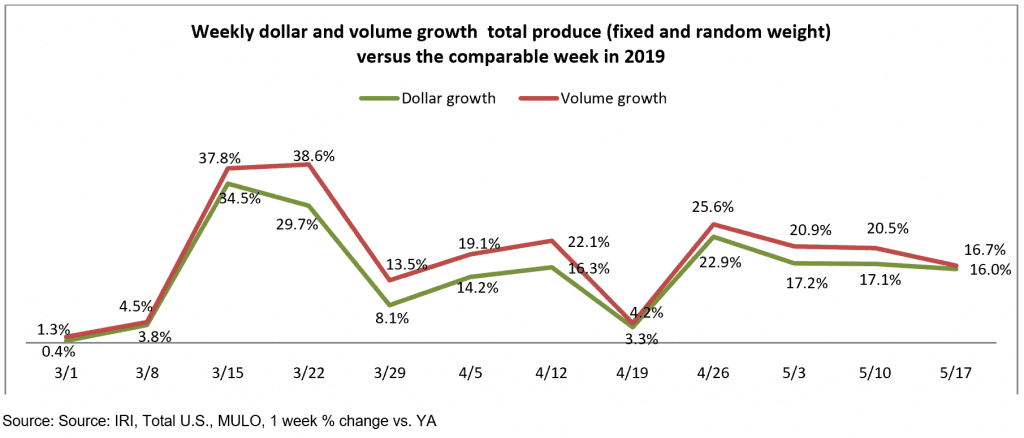

Dollars versus Volume

The volume/dollar gap narrowed significantly during the week of May 17 to 0.7 percentage points — the smallest gap since the onset of coronavirus-related shopping patterns in early March. At its widest, the volume/dollar gap was 8.9 percentage points during the second of the panic buying weeks. “Where other departments have seen significant inflation, prices were flat or down for most fresh fruits and vegetables,” said Parker. “Frequent front-page favorites, beef and pork, continue to see double-digit inflation, so now is the time to have fresh produce help drive price image.”

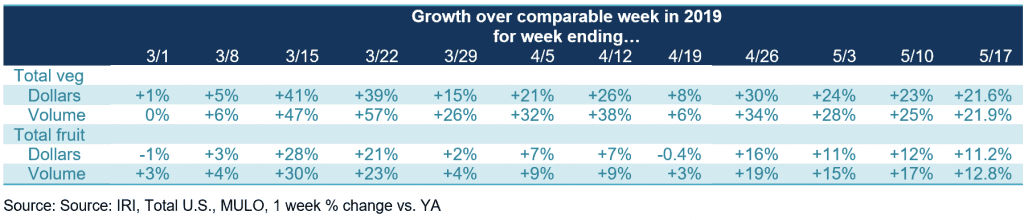

Both vegetables and fruit saw volume growth tracking ahead of dollars the week of May 17 versus the comparable week in 2019. However, the volume/dollar gap for fresh vegetables has come down to just 0.3 percentage points versus 1.6 points for fresh fruit.

The top three growth items in terms of absolute dollar gains over the same week in 2019 were berries, potatoes and lettuce. While the volume/dollar gap has started to narrow for several fruits and vegetables, some remained high, including peppers, avocados and onions.

“On the fruit side, we saw continued significant volume/dollar gaps for items such as pineapples (16 point gap), avocados (14 points) and apples (9 points),” said Watson. “For each, we see volume sales far exceed dollar sales, so the consumer demand is there, but the market conditions are putting pressure on price. But gaps for items such as melons have significantly narrowed, and others are actually seeing dollars track ahead of volume, including tangerines and kiwi.”

On the vegetable side, some areas saw volume track double digits ahead of dollars and others saw the reverse. For instance, peppers, onions, Brussels sprouts and cauliflower are all vegetables with significantly higher volume than dollar gains. However, potatoes, corn and asparagus are examples of vegetables were dollar gains outpaced volume growth. “As supply and demand will continue to change as foodservice demand is coming back online, this will be an area of continued change in weeks to come,” said Watson.

Fresh Fruit

“Fruit gains are holding their ground in recent weeks,” said Parker. “Cherries are the perfect example of an important summer fruit coming on strong, jumping right to being the seventh-highest seller for the week of May 17. This is cherries’ terrific impulse power at work, but an important question to ask ourselves is whether shoppers who are ordering online are aware of the new cherry crop being available. Communicating about new offerings on social and digital is more important than ever.” Six out of the top 10 items in terms of dollar sales saw double-digit increases during the week of May 17 versus the comparable week in 2019, whereas grape sales continued to see dollar sales pressure.

Fresh vegetables

All top 10 vegetable items in terms of dollar sales gained double-digits the week ending May 17, with the exception of carrots.

“From day one we have seen potatoes and mushrooms take big leaps over last year’s sales and that remained true well into May,” said Parker. “Gains like these, along with lettuce, peppers and onions is a clear sign that America is cooking- and valuing fresh produce in those preparations. That will have positive impacts for a long time to come.”

Lettuce was the top sales category and was the top contributor in absolute dollar growth in vegetables, adding $20 million in sales versus the comparable week in 2019.

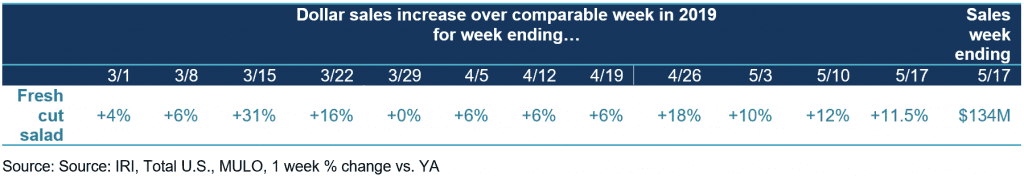

Fresh cut salad sales gains have been very stable for the past three weeks, between 10% to 12% above last year’s levels.

Fresh Versus Frozen and Shelf-Stable Fruits and Vegetables

While gains in frozen continued to outpace those in fresh and canned, the difference has grown significantly smaller since the two panic buying weeks. All areas of the store had double-digit growth once more, with frozen fruit reporting the highest gains, at +48.4%. Frozen fruit is also the smallest in terms of dollar sales of the six areas listed.

Perimeter performance

Gains for center-store edibles continued to outpace those in fresh during the week of May 17. Meat and produce sales were highly elevated, but these gains were pulled down by deli prepared and the in-store (fresh) bakery that have struggled since the end of March as quarantines ramped up.

What’s next?

The next sales report, covering week 11 of coronavirus’ affected shopping patterns, is the week of Memorial Day weekend. As the unofficial start of grilling season, this is also the kickoff for summer season produce sales.

IRI found that one-third of Americans had different plans than in 2019 with 19% saying they would not be hosting or attending get-togethers and 13% foregoing trips that they undertook in prior years. It is likely that just as seen with Easter and Mother’s Day, people celebrated the holiday, but celebrated in different ways. The net effect for the produce department will be in next week’s report.

Meanwhile, the relaxation of the stay-at-home executive orders looks different from state to state and encompasses everything from the partial re-opening of dine-in restaurants to the opening of hair salons and gyms to merely shifting from stay-at-home to safer-at-home. As states begin to enter their various re-opening phases, the economic and social readiness of consumers to re-engage with foodservice will become clearer. For the foreseeable future, it is likely that produce retail sales will continue to comfortably track ahead of last year’s base line for both fruit and vegetables.

Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times. #produce #joyoffresh #SupermarketSuperHeroes. 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns.