In the ninth week of coronavirus-related shopping, patterns continued to evolve. Between the typical Mother’s Day sales boost and shoppers flocking to the store once more to stock up on meat amid ongoing coverage of shortages, grocery sales had another good week, and produce along with it.

Trip, spending and channel choices continued to be in flux and fresh e-commerce is here to stay. All these developments had significant impact on fresh produce sales. 210 Analytics, IRI and PMA partnered to understand the effect for produce in dollars and volume throughout the pandemic.

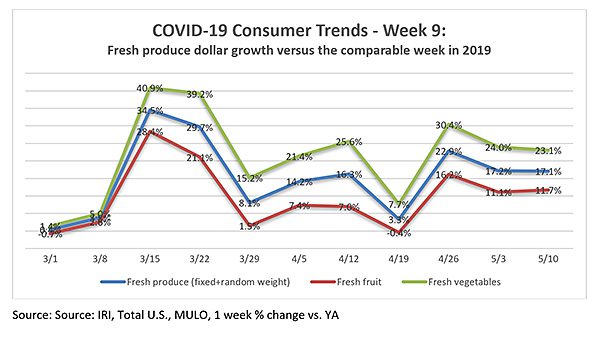

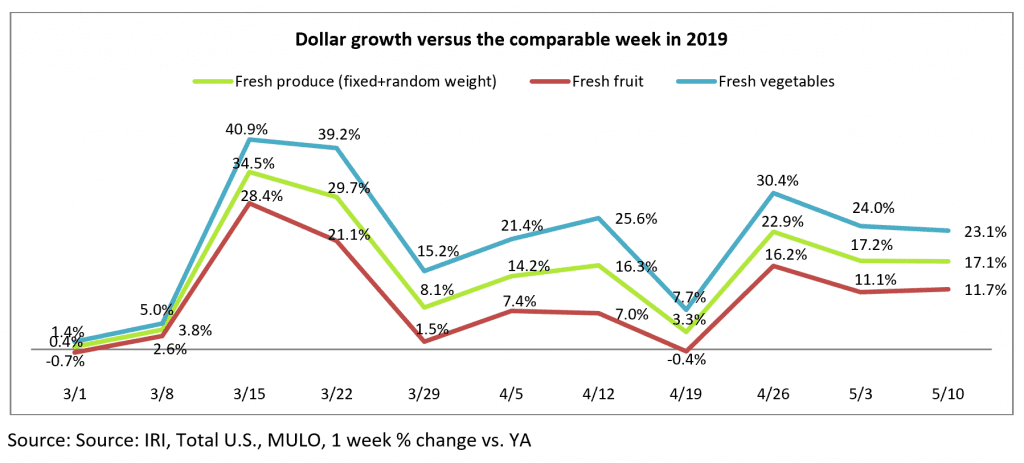

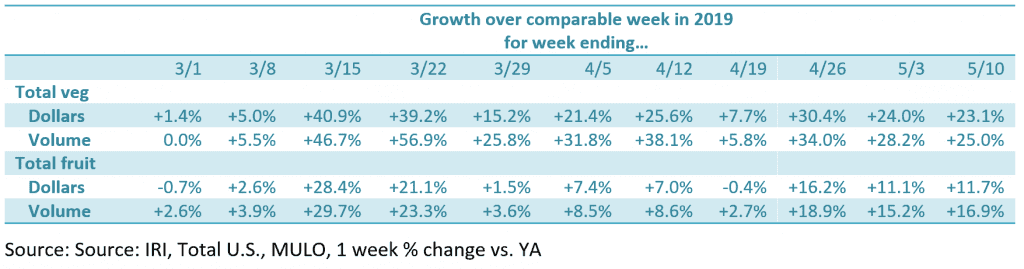

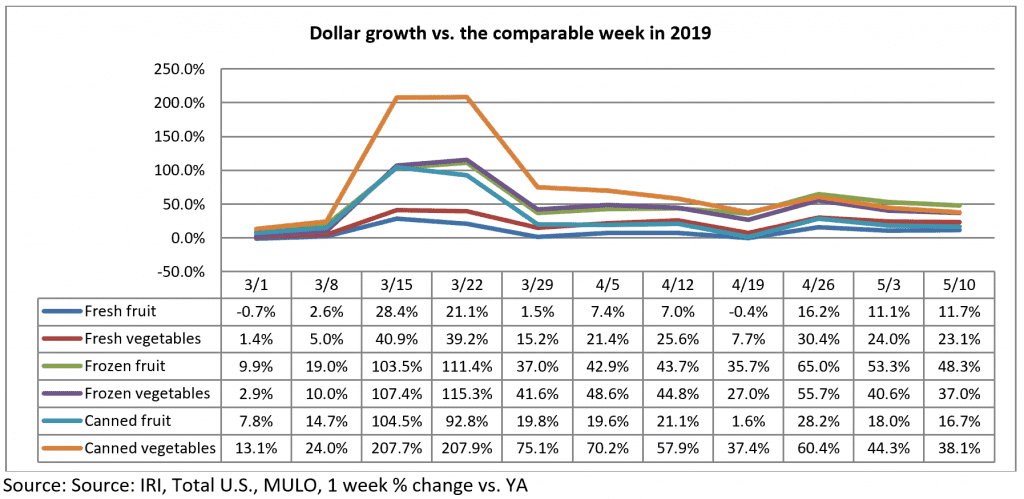

Fresh produce gains remained highly elevated the second week of May. Fresh produce growth for the week of May 10 versus the comparable week in 2019 increased 17.1% — virtually unchanged from the prior week. Fresh vegetables continued to easily outperform fruit, but both achieved double-digit increases. Meanwhile, consumer interest in all three temperature states for fruits and vegetables continued, with dollars split between fresh, frozen and shelf-stable. Frozen once more had the highest gains, up 39.2%, despite continued high out-of-stocks in the frozen food aisle.

- Fresh produce increased 17.1% over the comparable week in 2019.

- Frozen, +39.2%

- Shelf-stable, +28.8%

Source: IRI, Total US, MULO, % growth vs. year ago week ending May 10, 2020

“We have seen double-digit increases for fresh produce seven out of the past nine weeks,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “I am encouraged to see another week of 17% year-over-year growth. In addition to the elevated everyday demand because of more at-home meal occasions, the summer season has many holidays and celebrations, opportunity for backyard cookouts and slowly getting families and friends back together. As the meat department is challenged to add items for the weekly circular amid current shortages, the pressure is on the produce department to carry the front page. Let’s put the many summer fruits and vegetables in the spotlight!”

Fresh Produce

Compared with the same week in 2019, fresh produce generated an additional $209 million in sales during the week of May 10. Growth rates were in line with last week’s levels. Fresh vegetables, at +23.1%, continued to easily outperform fresh fruit and boasts double-digit increases for eight out of the last nine weeks.

“While tempting, it is still a little too early to make the call on how high the new normal lies above the old baseline,” said Jonna Parker, Team Lead, Fresh for IRI. “I have no doubt about it, the changed everyday demand is driving sizable sales gains versus year ago. But we also saw that the meat supply chain issues drove more people to stores to stock up on meat and poultry from which produce likely benefited as a complementary purchase. And importantly, the shift from dining out for Mother’s Day to in-home cooking also benefited produce this week.”

Parker refers to findings by the National Retail Federation found that 78% of consumers said celebrating Mother’s Day is important to them this year, given the pandemic. In past years, Mother’s Day has been the most popular holiday for eating out, in fact, in many cases was the busiest restaurant day of the year. According to the National Restaurant Association, typically two in five consumers eat out for Mother’s Day across meal occasions, or more than 92 million Americans. With restaurants still limited to takeout or capacity restrictions, celebratory spending boosted food retailing across departments. There is an important lesson in the cross-store spending boost for Mother’s Day and Easter before it. Consumers are celebrating, albeit differently than in prior years.

Parker added, “This time of year, with all the summer fruits and vegetables coming out, many retailers set up eye-catching displays and powerful holiday cross-merchandising displays. Knowing shoppers are rushing while in-store and are trying to minimize their trips, we need to challenge ourselves on how we can create virtual cross-merchandising and holiday displays in digital ads and online ordering platforms to support and inspire those purchases and celebrations. Just received the best batch of watermelons in years? Talk about it on social media and prompt excitement among your shoppers to partake.”

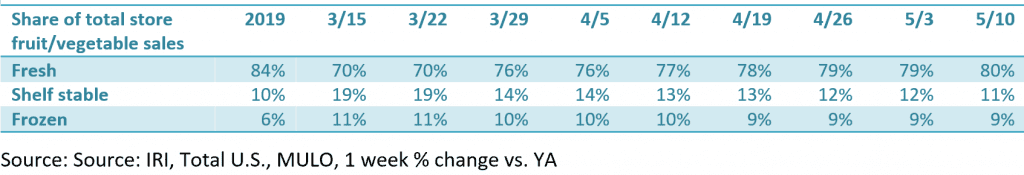

Fresh versus frozen and shelf-stable

Percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total produce. “Slowly but surely fresh is getting back to the market share it had pre-pandemic,” said Watson. “When shoppers were in their stock-up mindset, the share of fresh to total fruit and vegetable sales across the store stood as low as 70%, but in the latest week fresh is back to 80% despite some deflationary pressure.” Both frozen and canned have upward pressure on prices since the onset of coronavirus in the U.S.

Concern over the safety of fresh produce lingers for some shoppers. Some commented on the Retail Feedback Group’s Constant Customer Feedback (CCF) program this week.

One shopper wrote, “I witnessed an APPALLING situation as there was a young male shopper who was NOT a senior citizen with NO mask and NO gloves. He was fingering through produce and I was extremely upset about this as I am trying very hard to keep myself and my husband safe in this terrifying time.”

Watson commented, “It is important to continue to remind shoppers that fresh produce is safe to eat and that the supply chain is taking every possible measure to ensure safe and ample supply of fresh produce. Also remind consumers of their own role in applying good food safety measures while shopping and at home.”

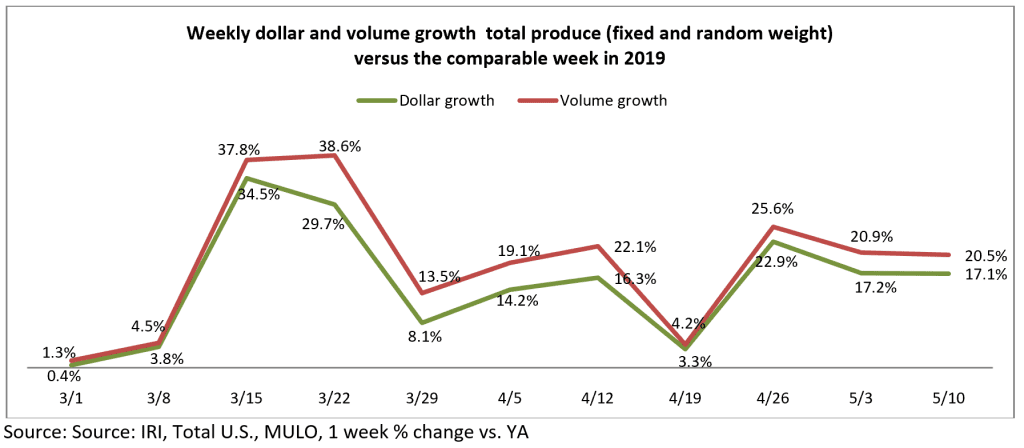

Dollars versus Volume

The volume/dollar gap narrowed slightly the week of May 10 to 3.4 percentage points, down from 3.7 points. However, this is much diminished from the week ending April 22, when the volume/dollar gap was 8.9 percentage points.

“Produce is one of the few departments where volume is tracking ahead of dollars,” said Watson. “While week after week we are documenting deflationary pressure for many fruits and vegetables, the most recent Bureau of Labor Statistics (BLS) on the Consumer Price Index (CPI) shows that food-at-home increased 2.6% over the month of March. Meat, eggs, baked goods, etc. all saw significant increases, due to the strain on supply and inability to easily shift from foodservice to food retail.”

Both vegetables and fruit saw volume growth tracking ahead of dollars the week of May 10 versus the comparable week in 2019.

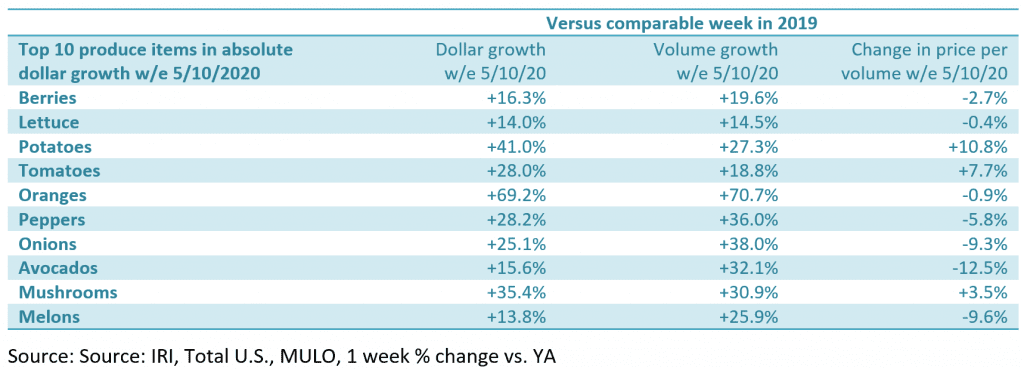

The top three growth items in terms of absolute dollar gains over the same week in 2019 were berries (+$26 million), potatoes (+$23 million) and lettuce and potatoes (+$22 million, each) and tomatoes (+$19 million). However, at the category level, big differences continued to exist between dollars and volume, driven by deflationary pressure. Within the top 10 growth items in absolute dollars, significant volume/dollar gaps remain for items, such as avocados, onions and melons.

“On the fruit side, we saw significant decreases in the price per volume versus the same week last year for items such as pineapples (17 percentage point decline), peaches (14 points), avocados (13 points) and melons (10 points),” said Watson. “For each, we see volume sales far exceed dollar sales, so the consumer demand is there, but the market conditions are putting pressure on price. But we are starting to see a few areas with price increases too, including tangerines, up +11% in price per volume versus year ago.”

On the vegetable side, there continued to be significant volume/dollar gaps in several areas. For instance, onions had a strong 25.1% boost in dollars, but volume sales were up 38.0%, with the retail price per volume down more than 12%. Others with high dollar/volume gaps were celery (30 percentage points), Brussels sprouts (27 points) and cauliflower (15 points). On the other hand, we saw some upward pressure as well for other items, particularly potatoes, with dollar sales still going strong, at +41.0%, and volume up 27.3%. Average price paid (dollars divided by volume) for potatoes was 10.8% higher versus the same week last year.

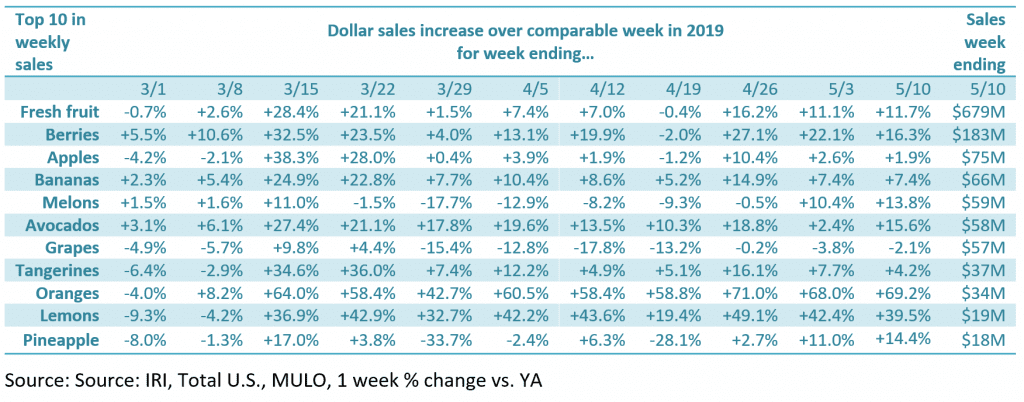

Fresh Fruit

“Fruit is hitting its stride here in the past few weeks,” said Parker. “While vegetables have seen a stronger performance during the pandemic, it is also fair to point out that vegetables had been outperforming fruit for a few years. The pandemic amplified that that difference but we see continued strength in items like oranges, lemons, avocados and berries — all sales powerhouses.”

Seven out of the top 10 items in terms of dollar sales saw double-digit increases during the week of May 10 versus the comparable week in 2019.

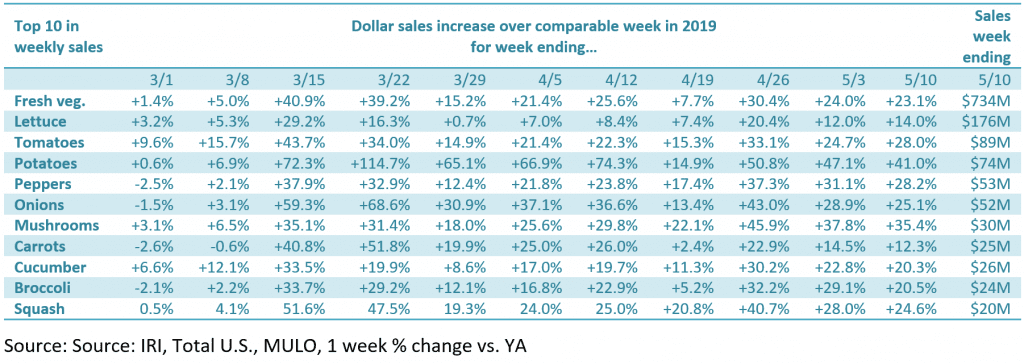

Fresh vegetables

All top 10 vegetable items in terms of dollar sales gained double-digits the week ending May 3, with increases ranging from +12.0% for lettuce to +47.1% for potatoes. “This is elevated everyday demand at work,” said Parker. “Excellent and prolonged gains in items like lettuce, potatoes, peppers and onions can only mean one thing: America is cooking. And that will have positive impacts for a long time to come.”

Lettuce was the top sales category, but potatoes were the top contributor in absolute dollar growth in vegetables, adding $23 million in sales versus the comparable week in 2019.

On the top fruits and vegetable performance Watson commented, “The summer season is upon us and typically that means a big emphasis on locally-grown corn, squash, melons and more. While we may be limited in setting up farmers’ market types displays outside or eye-catching displays inside, the power of local is here to stay. Analyses of sales patterns in Asia and Europe, countries that dealt with coronavirus before us, show an increased focus on local. While sampling and display trends may be different right now, locally-grown still makes for a very powerful social media and ad message.”

On the top fruits and vegetable performance Watson commented, “The summer season is upon us and typically that means a big emphasis on locally-grown corn, squash, melons and more. While we may be limited in setting up farmers’ market types displays outside or eye-catching displays inside, the power of local is here to stay. Analyses of sales patterns in Asia and Europe, countries that dealt with coronavirus before us, show an increased focus on local. While sampling and display trends may be different right now, locally-grown still makes for a very powerful social media and ad message.”

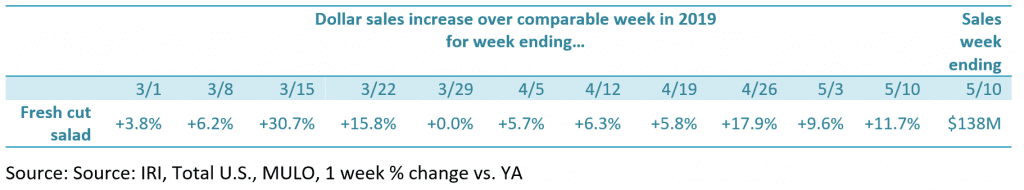

Fresh-Cut Salads

Fresh cut salad sales are accelerating once more, with solid year-over-year gains in dollars (+11.7%) and volume (+10.3%).

“The strength of frozen meal solutions shows that consumers are still looking for convenient dinner options in addition to their ‘quarantine cuisine’ from-scratch cooking,” said Parker. “For convenient lunches and dinners, cross-promote rotisserie chicken and ready-made salads, particularly for online pick-up or delivery orders taking place in the late afternoon and early evening.”

Fresh Versus Frozen and Shelf-Stable Fruits and Vegetables

Consumers continued to split their fruit and vegetable dollars three ways during the week of May 10. In addition to the strong performance of fresh vegetables, frozen and canned vegetables had ongoing strong growth during the second week of May as well. Vegetables continued to have higher gains in shelf-stable, but frozen fruit is gaining faster in frozen.

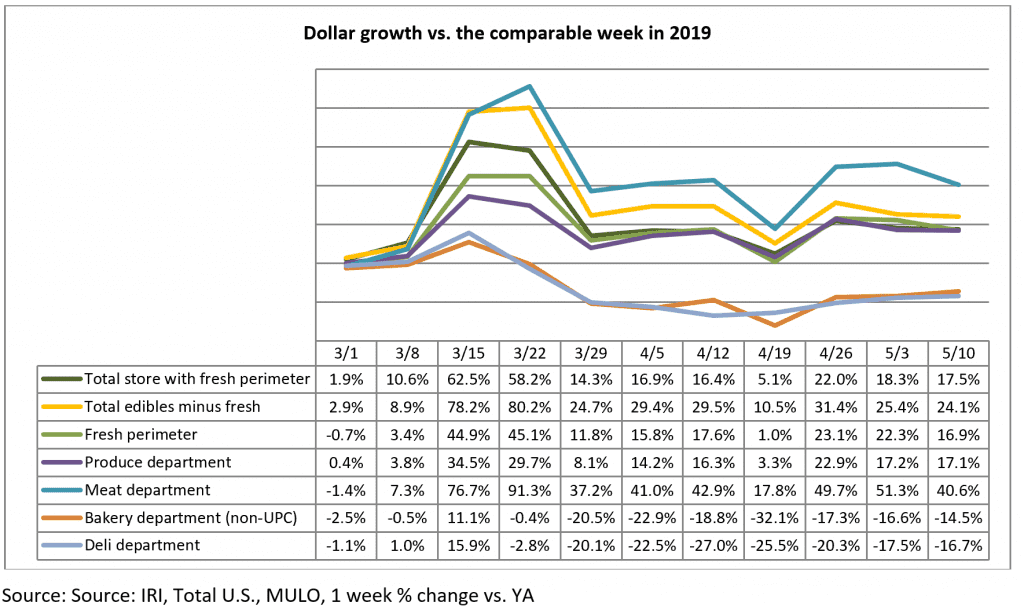

Perimeter performance

The week of May 10 was not as strong as the prior week, but food sales remained highly elevated versus year ago. Edibles excluding fresh were up 24.1% and the total fresh perimeter was up 16.9% — much in line with total produce growth. Meat, once more, was the star of the perimeter, while sales in the bakery and deli departments continued to struggle.

What’s next?

Next week’s sales report, covering week 10 of coronavirus in the U.S., is likely to be a pivotal point in the process of establishing what the next several months will look like. Nearly all U.S. states have started to partially re-open or have plans to do so. The relaxation of these stay-at-home executive orders looks different from state to state and encompasses everything from the partial re-opening of dine-in restaurants to the opening of hair salons and gyms to merely shifting from stay-at-home to safer-at-home. As states begin to enter their various re-opening phases, the economic and social readiness of consumers to re-engage with foodservice will become clearer. For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar.

Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times. #produce #joyoffresh #SupermarketSuperHeroes. 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns.