Data geeks who have been monitoring the growth of online grocery saw its popularity growing steadily, but not necessarily quickly.

Anne-Marie tells me the COVID-19 pandemic has pushed that growth to where analysts expected it to be in 2025, and, as more consumers become comfortable with the process, that growth is expected to continue long after we’re allowed to go back to stores.

What does that mean for impulse sales, particularly in fruit?

Or, read the transcript:

Pamela R.

Hey, this is Pamela Riemenschneider. I’m the Retail Editor for Blue Book Services and I have Anne-Marie here and we are going to talk about the latest sales numbers for some analysis Anne-Marie is doing with IRI and the Produce Marketing Association. So we have the numbers for week ending May 3. How is fresh produce doing?.

Anne-Marie Roerink, 210 Analytics

You know, first of all, May 3, if you think about it, we are now coming up on two months of this sales tracking in two months of vastly different grocery patterns. So two months is an interesting timeframe in terms of developing new habits. So how did they do well, a whole lot better than some of those earlier weeks and mid April, not as good as last week, but I don’t think we can complain about total produce being up 17.2% we continue to see that split between vegetables tracking far ahead, it’s 24% over the same week last year, and then fruit about 11% over the same week last year. So fruits still not as strong as we would have hoped we would like to see it closer to that vegetable growth. But, you know, really cannot complain about double digit growth at this point.

Pamela R.

And some of the things we’ve been talking about, that are challenging fruit are that fruit is for primarily when we talk about it, it’s a it’s an impulse buy. And people are not being very impulsive when they’re either shopping in the store or online.

Anne-Marie.

Yeah, so if you look at the developments and how this whole grocery shopping thing has gone over the last two months, initially, everybody was running from store to store to store to find all their toilet paper and whatever else they thought was necessary. And there was a very high frequency and a much smaller basket. Because people were just grabbing when they could and all these different stores. Over time you see it flipped. So there’s way fewer trips but a way higher basket. And so what is happening with shoppers is that they’re shopping less, really specifically pick one store and grocery stores right now that particular channel is really benefiting as well as Aldi, and some of those value focused stores. They’re grabbing a much larger share of total fresh including produce. But when people are in the store, they’re rushing through they’re you know, really making sure that that trip is as fast as it can be as well as covers them for the entire week until they go again. And I think part of that also factors into that continued strength that we’re seeing in both frozen and canned.

Pamela R.

Frozen and canned is kind of an interesting stat for you because you’ve also seen different people entering the category as of late.

Anne-Marie

Yeah, I thought that was fascinating. So one of the things that IRI looked at this particular week was what we call panel data. So it’s a little bit different than point of sales. And we can actually see a little bit more as to who is buying and what, where, and when. And so when they did that, they realized that when in frozen fruit. For those four weeks of March, there were 32% of the buyers that did not buy frozen fruit the same four weeks in 2019. And those 32% of new buyers so the frozen food category represented let me look here 62% of fruit sales numbers for frozen vegetables very, very similar. So in this case, it was 46% of frozen vegetables. So it’s not just bringing new feet down that frozen aisle, but they’re also representing very sizeable percentages of that growth that we’ve been seeing on the frozen side, same for canned so there’s absolutely a little bit more pressure and little, you know, just dividing up that dollar across really all produce zones in the store

Pamela R.

The growth of frozen in can kind of goes along with some of the things that we’ve been tracking consumers, you know, I looked and when you look at fresh produce and safety and things like that on Google Trends when you track those search trends, the number one related query, the fastest growing related query to fresh produce is Coronavirus. So consumers are really concerned about the safety of fresh produce. Of course, there’s a lot of campaigns a lot of efforts to assure people that fresh produce and safe then when you actually tick down on it, we also have another stat that goes along with some of the things we’ve been talking about. It’s fresh produce delivering your me. So people are also turning to online or turning direct consumer. And you have some interesting stats about online, don’t you?

Anne-Marie

Yeah, well, first of all, you’ll have to teach me how to do that. The Coronavirus is it safe to eat fresh produce that’s fascinating to me. In that same frozen food survey that we’ve talked about before, we found actually that 15% of consumers said, I’m now buying frozen fruit and veggies, because I’m a little concerned about buying fresh right now. So there is concern in consumer comments, we see things come back, like have hand sanitizer stations and more bags, maybe bag up to produce for me, what are all the different things that you’re doing to keep the food supply safe? So that’s interesting to see that that actually starts to pop up in Google searches as well. And I think that’s a big part of our communications, regardless of where you’re at in the supply line to talk about the safety. Online. Yes, huge, huge jump. Data geeks like me, we talked about you know, there’s a growth curve and it had really slowed down for online engagement, where people were trying but they tried it once or twice and kind of fell back out of it. So there was a hard core, but didn’t really stick with it. Well, now if you look at the growth trajectory and where we are at today versus where we thought we would be, it’s 2025. Now. A lot of these people, what we’re seeing numbers if you have ordered online three times, and you’ve invested that time to build your whole shopping list, and now you’re starting to benefit from having your past purchases, your favorites and everything else, then all of a sudden that snowball starts to roll downhill and it starts to actually benefit people, then they’re starting to have more comfort, they’re starting to order more fresh food, which typically initially are not in fresh baskets. So the longer this takes and the more orders will happen online, I think the more this actually starts to grow initiative, including growth for fresh and that is going to just drastically you talked earlier about impulse for fruit, you know, think about the impact that will have on fruit sales and how are you going to create impulse online. Think about the reason for ordering online. It’s safety in stores not necessarily convenience among those newer shoppers that are older than the typical millennial that was the online shopper. So just drastic impact. I think.

Pamela R.

We even kind of kicked this around in our pregame a couple of weeks ago, about some stores going dark to just make it even safer. And that actually happened at a Whole Foods store in the Chicago area. They’ve closed a traditional store and turned it dark to online orders only. So we’re seeing retailers tiptoe step around pilot these programs to see if this is something they want to continue into in the in the long term and it just speaks to the strength of online ordering and the demand for it that If there wasn’t demand for it, they wouldn’t be closing an entire store.

Anne-Marie

Absolutely, absolutely. I think you know, the comments that I’m seeing come back from consumers, they’re very fascinating. In that they, we’re expecting to have a bad experience with fresh and frozen. So often I see comments that say, oh, wow, everything was packed in a separate bag and it was still cold with almost you can just hear the surprise in their, in their words. And, you know, the fact that the heavier items were packed on the bottom and all this, this surprised with the quality of their online order relative to fresh and so, again, I think the more often people do it, the more satisfied their experiences, the more we’re going to see this growth continue.

Pamela R.

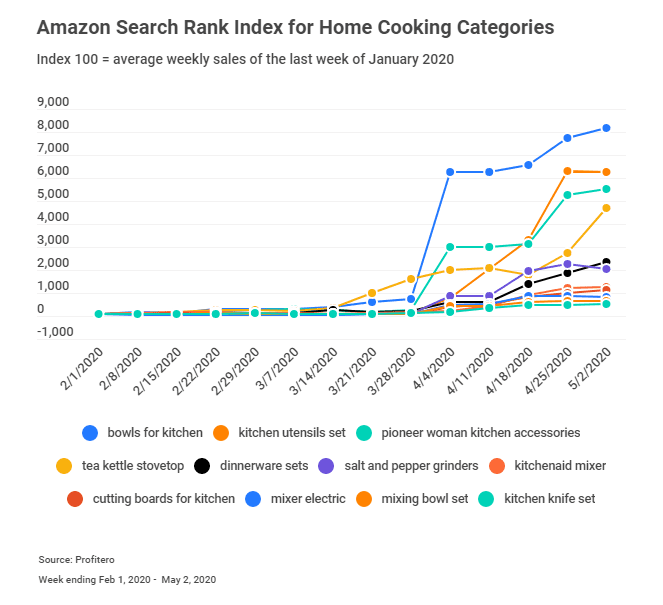

We’ve also seen some growth in different areas. And we you know, we talked about the numbers first, of course, the sales numbers is the first reason we’re here. But also we’re kind of trying to pick apart the consumer, the new consumer and how consumers are settling into their lives um you know compared to last year compared to six months ago and I you sent over a really fascinating set of numbers from Profitero about search index for home cooking categories what’s going on with home cooking?

Anne-Marie

I thought it was fascinating. So you know of course as researchers, we all ask the question, are you cooking at home? Well, duh, yes we are. 90% of shoppers say they do. Now if you think about that, how does that impact breakfast and lunch and snacks and all these different things that we used to at least in part, outsource to foodservice. And a couple of weeks ago Profitero came out with a chart talked about the huge spike in buying instant pots and air fryers and pizza makers, bread bakers and you know, just talking to friends around me everybody is baking bread in their little breadmakers now, but then this chart you’re talking about just shows me two different things. You know, we’re seeing gigantic I mean nearly a straight line up for things like kitchen bowls I think it was knives I mean basic basic things.

Pamela R.

Tea Kettles!

Anne-Marie

Yes. And so to me it shows me yeah so a lot of people weren’t cooking before because if you need to buy a bowl and a knife then tell me what kind of kitchen where you’re running? But it also shows that people are investing in those items and maybe starting to enjoy it or certainly engaging with recipe searches, tips on how to do certain things. So I you know, we can really make this a fun experience and good experience man that can just really drive sales in for years.

Pamela R.

For years. Either that or like I said, I mean in six months when everyone’s gone back to their normal shopping and eating patterns. I will find all that at the thrift store when they donated it to get rid of all this extra clutter. Either way, somebody’s winning

All right, well, we will watch for next week’s numbers that will be week ending May 10. I’m going to I’m going to call it where we’re going to see a little bit less because everyone flocked to the to the foods restaurants for Mother’s Day. I mean, especially around here all of the pickup and delivery and takeout and everyone was jam packed. So I’m going to say that maybe there was a little bit lower sales, but maybe not, maybe I’ll be wrong.

Anne-Marie

Yeah, we’ll have to see I mean some states obviously restaurants are still not even open not even with limited capacity. Others have started to open back up. I would agree with you that typically Mother’s Day is a big out spoil mom kind of occasion. I saw some retailers have some cross merchandising online with all the items from Mother’s Day brunch. I thought that was fantastic starting to take those in store displays and putting them online. So we’ll see what our Mother’s Day provided. a bump or not.