SAN DIEGO – Deep discount retailers’ growth is on the rise, and independent grocers need to focus on what they do better to keep from becoming victims of the discounters’ success.

Bill Bishop, chief architect and co-founder of Brick Meets Click consultancy, said deep discounters – such as Aldi and Lidl – project to grow to 10 percent of grocery sales by 2021, and they’re in many of the markets independent grocers exist.

Speaking to attendees of the National Grocers Association’s annual convention Feb. 24 in San Diego, he said that estimate may even be low if they break into the New York market.

But there are a handful of things independent grocers can do to stay competitive with these stores.

- First, they should assess their strengths and weaknesses and focus on strengths.

- Second, make ad prices lower than the discounters’ every day low prices on certain items.

- Third, emphasize their connection to local communities, something the discount chains aren’t nimble enough to do well.

- Fourth, focus on their best customers.

“In the shopper’s mind, focus on your competitive advantage,” Bishop said.

In many cases, that will be in perishables, such as fresh produce and meat.

“They project very low prices on dairy, meat and produce,” he said, which can be a challenge for independent retailers, but they can point to locally produced produce and meat to differentiate.

“It’s less about competing head-to-head and more about being strategic,” Bishop said, noting that discounters aren’t going to take over the world.

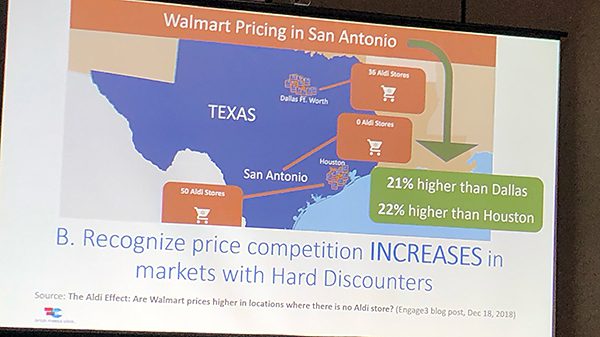

Discounters certainly create price competition in markets they’re in, he said, pointing to Texas as an example, where deep discounters in Dallas and Houston have forced Walmart to lower prices in those markets compared to Walmart’s prices overall in San Antonio, where discounters haven’t entered the market.

But being competitive with these stores on price can’t be the only strategy.