Additional taxes?

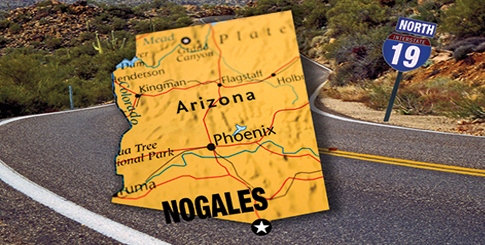

Another aspect of the continuing controversy over President Trump’s proposed border wall is a cause of concern for those doing business on both sides of the border.

In July of last year, the administration floated the idea of a surtax on Mexican imports as high as 20 percent to fund the construction of the wall—a figure that would have a massive impact on the billions of pounds of fruits and vegetables that come from Mexico every year.

While the tax might raise as much as a billion dollars to defray the costs of a border wall, the realities of the market make it clear that it would actually be the American consumer, not the Mexican government, who would bear the brunt of the costs, as produce prices would rise to compensate for the additional tax burden.

“This would really have an impact on the industry,” contends Franzone, “and would make it difficult for us to follow through on our commitments to our customers.”

Because of the interconnectedness of so many businesses in Nogales, from shipping and distribution to service and construction, the tax could send shockwaves through the entire local economy. “Hopefully we can come up with another approach,” Graney speculates, “because right now there’s just no way to predict the impact a tax of this nature would have.”

Forward motion

Still, there are many reasons to be hopeful. The Nogales ports of entry have added over a million square feet of additional storage over the last decade, and a $330 million infrastructure upgrade has been completed, including full FAST (Free and Secure Trade) capability for all truck lanes.

In addition, as of last summer, major pushes to ensure compliance with the Foreign Supplier Verification Program was underway through webinars, online resources, and international training programs, all of which were seeing strong support.

The regulatory landscape in Nogales may be changing, but the port and its customers aren’t standing still—they’re moving forward with purpose.

Entering the Future

On the produce side of the business coin, industry members are employing technology, new funding, and relying on the support of local political leaders who are more familiar with the nature of cross-border trade than their Washington counterparts.

“The industry today doesn’t look anything like it did when I first got into it,” reflects Delta Brokerage’s Graney. “But the people who work here now are capable of dealing with things we never imagined having to deal with.”