The Discount Wars

Most of the national retailers’ success stories have come on either the discount or the specialty end of the market. “There are two polarizing tendencies, first the move toward discount formats of some kind that can compete on price, and second toward more of an upscale specialty retailer that appeals to an urban demographic,” says Uduslivaia.

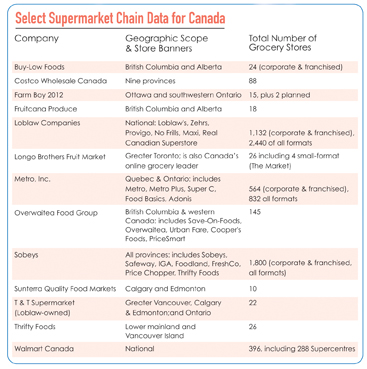

Sobeys, Metro, and Loblaw are repositioning and rebranding many of their stores into their most successful formats, she says. “As opposed to having a gazillion banners, they’re now focusing on a few key banners.” Many of these are discount formats, including Loblaw’s No Frills, Sobeys’ FreshCo, and Metro’s Food Basics.

Uduslivaia points out that Walmart’s strong inroads into the market have driven many consumers to the discount tier and raised the stakes on the produce front by merchandising fresh fruits and vegetables at the front of the store, putting freshness at a premium, especially in urban formats.

Unlike Walmart, Target, which entered the market in 2011, did not fare well and withdrew from the Canada retail landscape altogether in 2015. “They did everything right in terms of preparing to enter the country,” Uduslivaia says, “but after they opened, it was another story.” Not only was Target unable to find its identity, she says, but stores were often out of stock or didn’t have the right product mix or pricing for Canadian shoppers. The result was reminiscent of British grocery giant Tesco’s debut in America under the Fresh & Easy banner, which ended in bankruptcy in 2013.

Pricing and Concessions

Meanwhile, the three leading chains, along with long-established warehouse chain Costco Canada, are taking steps to address the competition from Walmart. “The four incumbents are not standing around while Walmart and Amazon are expanding,” says Ed Strapagiel, an independent retail consultant in Toronto.